-

World leaders set to attend Francis's funeral as cardinals gather

World leaders set to attend Francis's funeral as cardinals gather

-

Gold hits record, stocks mixed as Trump fuels Fed fears

-

Roche says will invest $50 bn in US over next five years

Roche says will invest $50 bn in US over next five years

-

Fleeing Pakistan, Afghans rebuild from nothing

-

US Supreme Court to hear case against LGBTQ books in schools

US Supreme Court to hear case against LGBTQ books in schools

-

Pistons snap NBA playoff skid, vintage Leonard leads Clippers

-

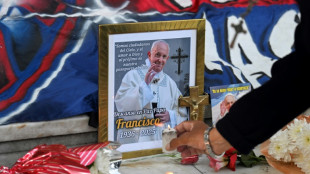

Migrants mourn pope who fought for their rights

Migrants mourn pope who fought for their rights

-

Duplantis kicks off Diamond League amid Johnson-led changing landscape

-

Taliban change tune towards Afghan heritage sites

Taliban change tune towards Afghan heritage sites

-

Kosovo's 'hidden Catholics' baptised as Pope Francis mourned

-

Global warming is a security threat and armies must adapt: experts

Global warming is a security threat and armies must adapt: experts

-

Can Europe's richest family turn Paris into a city of football rivals?

-

Climate campaigners praise a cool pope

Climate campaigners praise a cool pope

-

As world mourns, cardinals prepare pope's funeral

-

US to impose new duties on solar imports from Southeast Asia

US to impose new duties on solar imports from Southeast Asia

-

Draft NZ law seeks 'biological' definition of man, woman

-

Auto Shanghai to showcase electric competition at sector's new frontier

Auto Shanghai to showcase electric competition at sector's new frontier

-

Tentative tree planting 'decades overdue' in sweltering Athens

-

Indonesia food plan risks 'world's largest' deforestation

Indonesia food plan risks 'world's largest' deforestation

-

Gold hits record, stocks slip as Trump fuels Fed fears

-

Trump helps enflame anti-LGBTQ feeling from Hungary to Romania

Trump helps enflame anti-LGBTQ feeling from Hungary to Romania

-

Woe is the pinata, a casualty of Trump trade war

-

'Like orphans': Argentina mourns loss of papal son

'Like orphans': Argentina mourns loss of papal son

-

Trump tariffs torch chances of meeting with China's Xi

-

X rival Bluesky adds blue checks for trusted accounts

X rival Bluesky adds blue checks for trusted accounts

-

China to launch new crewed mission into space this week

-

Morocco volunteers on Sahara clean-up mission

Morocco volunteers on Sahara clean-up mission

-

Latin America fondly farewells its first pontiff

-

'I wanted it to work': Ukrainians disappointed by Easter truce

'I wanted it to work': Ukrainians disappointed by Easter truce

-

Harvard sues Trump over US federal funding cuts

-

'One isn't born a saint': School nuns remember Pope Francis as a boy

'One isn't born a saint': School nuns remember Pope Francis as a boy

-

Battling Forest see off Spurs to boost Champions League hopes

-

'I don't miss tennis' says Nadal

'I don't miss tennis' says Nadal

-

Biles 'not so sure' about competing at Los Angeles Olympics

-

Gang-ravaged Haiti nearing 'point of no return', UN warns

Gang-ravaged Haiti nearing 'point of no return', UN warns

-

US assets slump again as Trump sharpens attack on Fed chief

-

Forest see off Spurs to boost Champions League hopes

Forest see off Spurs to boost Champions League hopes

-

Trump says Pope Francis 'loved the world,' will attend funeral

-

Oscar voters required to view all films before casting ballots

Oscar voters required to view all films before casting ballots

-

Bucks' Lillard upgraded to 'questionable' for game 2 v Pacers

-

Duplantis and Biles win Laureus World Sports Awards

Duplantis and Biles win Laureus World Sports Awards

-

US urges curb of Google's search dominance as AI looms

-

The Pope with 'two left feet' who loved the 'beautiful game'

The Pope with 'two left feet' who loved the 'beautiful game'

-

With Pope Francis death, Trump loses top moral critic

-

Mourning Americans contrast Trump approach to late Pope Francis

Mourning Americans contrast Trump approach to late Pope Francis

-

Leeds and Burnley promoted to Premier League

-

Racist gunman jailed for life over US supermarket massacre

Racist gunman jailed for life over US supermarket massacre

-

Trump backs Pentagon chief despite new Signal chat scandal

-

Macron vows to step up reconstruction in cyclone-hit Mayotte

Macron vows to step up reconstruction in cyclone-hit Mayotte

-

Gill, Sudharsan help toppers Gujarat boss Kolkata in IPL

ExxonMobil to buy Texas shale producer Pioneer for about $60 bn

ExxonMobil sealed a megadeal to acquire Pioneer Natural Resources for about $60 billion, bolstering its holdings in the Permian Basin, a key US petroleum region, the companies announced Wednesday.

Under the all-stock transaction, ExxonMobil will buy Texas-based Pioneer for $59.5 billion based on ExxonMobil's closing price on October 5. The overall transaction, including debt, is valued at around $64.5 billion, the companies said.

ExxonMobil said the takeover, the company's biggest since the late 1990s acquisition of Mobil by Exxon, will enable greater economies of scale, permitting it to deploy drilling and operating technologies over a bigger region.

"The combined capabilities of our two companies will provide long-term value creation well in excess of what either company is capable of doing on a standalone basis," said ExxonMobil Chief Executive Darren Woods.

The "highly contiguous" drilling acreage of the two companies will allow "for greater opportunities to deploy our technologies, delivering operating and capital efficiency as well as significantly increasing production," Woods said.

Production in the Permian Basin, located in western Texas and eastern New Mexico, accounts for a whopping 5.8 million barrels of oil per day, or about 45 percent of US output.

- Shale revival -

The region has a long and storied history, with the first wells dating to 1920. The basin soared during the energy boom of the 1970s before experiencing a steady decline in subsequent decades.

The US shale boom of the 2010s revived the area, with fracking and new drilling techniques that make development more affordable.

Both ExxonMobil and fellow US petroleum behemoth Chevron have invested heavily in the region in recent years.

With the Pioneer acreage, ExxonMobil will be able to drill some wells as long as four miles, boosting efficiency the oil giant said would enable it to produce the acquired acreage for less the $35 a barrel.

The takeover comes as oil currently trades at more than $85 a barrel, a relatively high historical benchmark.

ExxonMobil vowed that it would employ best practices on the environment, accelerating Pioneer's plan to reach "net zero" emissions by 15 years to 2035 and employing technology to limit methane emissions.

But as a longterm bet on oil and gas, the merger is unlikely to please climate activists.

ExxonMobil has long faced criticism that it intentionally fueled doubts about climate change science in order to protect its core business.

Under Woods, the company has established a low-carbon business, having acquired Denbury Inc., a specialist in enhanced oil recovery and carbon sequestration, for $4.9 billion earlier this year.

While ExxonMobil usually avoids big deals under a high price scenario, analysts noted that Pioneer's shares had retreated prior to speculation of the deal.

Another factor favoring a deal was the impending retirement of Pioneer CEO Scott Sheffield, who has planned to step down at the end of 2023.

Shares of Pioneer jumped 2.0 percent in pre-market trading, while ExxonMobil dropped 2.5 percent.

S.Spengler--VB