-

T'Wolves dominate Lakers, Nuggets edge Clippers as NBA playoffs start

T'Wolves dominate Lakers, Nuggets edge Clippers as NBA playoffs start

-

Taxes on super rich and tech giants stall under Trump

-

Star Wars series 'Andor' back for final season

Star Wars series 'Andor' back for final season

-

Neighbours improvise first aid for wounded in besieged Sudan city

-

Tariffs could lift Boeing and Airbus plane prices even higher

Tariffs could lift Boeing and Airbus plane prices even higher

-

Analysts warn US could be handing chip market to China

-

Unbeaten Miami edge Columbus in front of big MLS crowd in Cleveland

Unbeaten Miami edge Columbus in front of big MLS crowd in Cleveland

-

Social media helps fuel growing 'sex tourism' in Japan

-

'Pandora's box': alarm bells in Indonesia over rising military role

'Pandora's box': alarm bells in Indonesia over rising military role

-

Alaalatoa hails 'hustling hard' Brumbies for rare Super Rugby clean sheet

-

Trio share lead at tight LA Championship

Trio share lead at tight LA Championship

-

Sampdoria fighting relegation disaster as old heroes ride into town

-

Recovering pope expected to delight crowds at Easter Sunday mass

Recovering pope expected to delight crowds at Easter Sunday mass

-

Nuggets edge Clippers in NBA playoff overtime thriller, Knicks and Pacers win

-

Force skipper clueless about extra-time rules in pulsating Super Rugby draw

Force skipper clueless about extra-time rules in pulsating Super Rugby draw

-

Nuggets edge Clippers in NBA playoff overtime thriller, Pacers thump Bucks

-

Unbeaten Miami edge Columbus in front of big crowd in Cleveland

Unbeaten Miami edge Columbus in front of big crowd in Cleveland

-

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

-

Another round of anti-Trump protests hits US cities

Another round of anti-Trump protests hits US cities

-

'So grateful' - Dodgers star Ohtani and wife welcome first child

-

PSG maintain unbeaten Ligue 1 record, Marseille back up to second

PSG maintain unbeaten Ligue 1 record, Marseille back up to second

-

US, Iran report progress in nuclear talks, will meet again

-

US Supreme Court intervenes to block Trump deportations

US Supreme Court intervenes to block Trump deportations

-

Hamas armed wing says fate of US-Israeli captive unknown

-

Pacers thump Bucks to open NBA playoffs

Pacers thump Bucks to open NBA playoffs

-

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

-

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

-

'Fuming' Watkins fires Villa in bid to prove Emery wrong

-

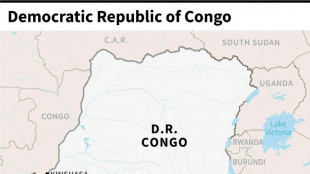

DR Congo boat fire toll revised down to 33

DR Congo boat fire toll revised down to 33

-

England thrash Scotland to set up France Grand Slam showdown

-

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

-

McTominay fires Napoli level with Inter as Conte fuels exit rumours

-

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

-

Man City boost top five bid, Aston Villa thrash in-form Newcastle

-

Villa rout Newcastle to rekindle bid to reach Champions League

Villa rout Newcastle to rekindle bid to reach Champions League

-

Dumornay gives Lyon lead over Arsenal in Women's Champions League semis

-

Trans rights supporters rally in London, Edinburgh after landmark ruling

Trans rights supporters rally in London, Edinburgh after landmark ruling

-

'We have to wait': Barca's Flick on Lewandowski injury fear

-

Bordeaux-Begles backups edge Pau to close in on Top 14 summit

Bordeaux-Begles backups edge Pau to close in on Top 14 summit

-

Trans rights supporters rally outside in London, Edinburgh after landmark ruling

-

PSG beat Le Havre to stay on course for unbeaten Ligue 1 season

PSG beat Le Havre to stay on course for unbeaten Ligue 1 season

-

Man City close in on Champions League with Everton late show

-

14-year-old Vaibhav Suryavanshi becomes youngest IPL player

14-year-old Vaibhav Suryavanshi becomes youngest IPL player

-

Barca make stunning comeback to beat Celta Vigo in Liga thriller

-

Zverev sets up birthday bash with Shelton in Munich

Zverev sets up birthday bash with Shelton in Munich

-

Man City boost top five bid, Southampton snatch late leveller

-

US Supreme Court intervenes to pause Trump deportations

US Supreme Court intervenes to pause Trump deportations

-

Alcaraz and Rune race into Barcelona final

-

US, Iran to hold more nuclear talks after latest round

US, Iran to hold more nuclear talks after latest round

-

Man City close in on Champions League thanks to Everton late show

US Federal Reserve with “announcement”

In a widely-followed press conference, the US Federal Reserve (Fed) announced a significant economic contraction in order to control the growing risk of inflation in the United States. With this decision, the central bank is reacting to persistently high rates of inflation and a rapidly changing economic situation. At the same time, the measure sends a signal to companies and financial markets: after a phase of historically low interest rates and extremely loose monetary policy, the course could now change in the direction of a more restrictive phase.

Rising interest rates and tighter monetary policy:

Contrary to the course of recent years, when the Federal Reserve supported the economy with low interest rates, the focus is now on interest rate hikes and a reduction in the Fed's balance sheet. This is intended to dampen excessive demand, slow credit growth and contain inflation. Fed Chairman Jerome Powell emphasized that these steps are necessary to ensure sustainable and stable economic development over the medium term.

Market analysts see the announced contraction as a significant policy shift. Many investors had already expected interest rate hikes, but the clear focus on a restrictive policy exceeded the expectations of some observers. As a result, stock markets came under short-term pressure and the US dollar depreciated slightly against other leading currencies.

Background: Inflation and economic uncertainties:

The rate of inflation in the US has reached record levels in recent months. Supply bottlenecks, rising energy prices and high consumer demand had noticeably driven up prices. In addition, numerous economic stimulus packages initiated in response to the coronavirus crisis have stabilized the economy, but have also led to a high amount of money in circulation.

With the announcement of an economic contraction, the Fed is seeking a balance: on the one hand, price stability and a reduction in speculative bubbles should be ensured, while on the other hand, the Fed wants to avoid an excessive cooling of the economy. Jerome Powell emphasized that developments are being monitored closely and that the Fed is prepared to take action if necessary.

Impact on companies and consumers:

A more restrictive monetary policy primarily affects companies that have relied on cheap credit. For firms that finance growth through debt, costs could now rise, which could slow investment and expansion in some sectors.

Consumers are also likely to feel the effects of rising interest rates, especially real estate buyers and credit card customers. Higher mortgage rates could put the brakes on the residential real estate market and make buying a home more expensive.

At the same time, however, there are also positive aspects: an effective fight against inflation preserves the purchasing power of the population and can reduce speculation risks. In particular, people with savings could benefit from higher interest rates, provided that financial institutions adjust their rates.

Criticism and outlook:

Not all experts consider the Federal Reserve's move to be appropriate. Some critics warn that curbing growth too quickly could jeopardize new jobs and slow down the economic recovery after the pandemic. The fear is that if the US economy cools more sharply than expected, the labor market could deteriorate again and high inflation could only moderate moderately.

Nevertheless, many experts see the decision as overdue. In view of record inflation and a stock market environment that is overheated in some areas, there is a need for action to stabilize the fundamental data again. The coming months will show whether the US economy can strike a balance between stabilizing and avoiding a recession – or whether a more severe downturn is looming.

Conclusion:

The Federal Reserve has sent a clear signal to markets and consumers with its announcement of an economic contraction. Higher key interest rates and a tighter monetary policy should curb the record inflation and enable a more balanced economy. At the same time, there are risks for growth and the labor market if the economic environment deteriorates more quickly than expected. It remains to be seen whether this balancing act will be successful, but it is clear that the latest step marks the beginning of a new phase in US monetary policy.

EU: No agreement on 10-year extension for glyphosate

Ukraine: When will the world stand up to Russian terror?

Warming: Methane levels rising, is this nature's answer?

Israel has every right to destroy Hamas and Hezbollah!

What are the effects of climate change on sea flora?

Azerbaijan is in control: Armenians flee Nagorno-Karabakh

EU countries agree on watered-down car emissions proposal

Hungary-Dictator PM Orban claims EU 'deceived' Hungary

Ruble at the end: Russia's currency on the brink of collapse

Russia in Ukraine: murder, torture, looting, rape!

That's how terror Russians end up in Ukraine!