-

World leaders pay tribute to Pope Francis, dead at 88

World leaders pay tribute to Pope Francis, dead at 88

-

World leaders react to the death of Pope Francis

-

Zimbabwe lead first Test despite Bangladesh spinner Mehidy's five wickets

Zimbabwe lead first Test despite Bangladesh spinner Mehidy's five wickets

-

Vatican postpones sainthood for 'God's influencer' after pope's death

-

Pope's death prompts CONI to call for sporting postponements, minute's silence

Pope's death prompts CONI to call for sporting postponements, minute's silence

-

Stunned and sad, faithful gather at St Peter's to remember Francis

-

Asian scam centre crime gangs expanding worldwide: UN

Asian scam centre crime gangs expanding worldwide: UN

-

Davos meet founder Klaus Schwab steps down from WEF board

-

Himalayan snow at 23-year low, threatening 2 billion people: report

Himalayan snow at 23-year low, threatening 2 billion people: report

-

The beautiful game: Pope Francis's passion for football

-

Clerical sex abuse: Pope Francis's thorniest challenge

Clerical sex abuse: Pope Francis's thorniest challenge

-

Pope Francis's delicate ties with politics in Argentina

-

Russia resumes attacks on Ukraine after Easter truce

Russia resumes attacks on Ukraine after Easter truce

-

Pope Francis has died aged 88

-

Gaza civil defence describes medic killings as 'summary executions'

Gaza civil defence describes medic killings as 'summary executions'

-

Francis: radical leader who broke the papal mould

-

Oscar stars, Max keeps mum, Sainz alive - Saudi GP talking points

Oscar stars, Max keeps mum, Sainz alive - Saudi GP talking points

-

Iyer, Kishan win back India contracts as Pant's deal upgraded

-

Vance lands in India for tough talks on trade

Vance lands in India for tough talks on trade

-

Inside South Africa's wildlife CSI school helping to catch poachers

-

Nigerian Afrobeat legend Femi Kuti takes a look inward

Nigerian Afrobeat legend Femi Kuti takes a look inward

-

Kim Kardashian: From sex tape to Oval Office via TV and Instagram

-

Vance in India for tough talks on trade

Vance in India for tough talks on trade

-

Thunder crush Grizzlies as Celtics, Cavs and Warriors win

-

Vance heads to India for tough talks on trade

Vance heads to India for tough talks on trade

-

China slams 'appeasement' of US as nations rush to secure trade deals

-

'Grandpa robbers' go on trial for Kardashian heist in Paris

'Grandpa robbers' go on trial for Kardashian heist in Paris

-

Swede Lindblad gets first win in just third LPGA start

-

Gold hits record, dollar drops as tariff fears dampen sentiment

Gold hits record, dollar drops as tariff fears dampen sentiment

-

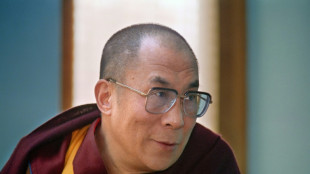

As Dalai Lama approaches 90, Tibetans weigh future

-

US defense chief shared sensitive information in second Signal chat: US media

US defense chief shared sensitive information in second Signal chat: US media

-

Swede Lingblad gets first win in just third LPGA start

-

South Korea ex-president back in court for criminal trial

South Korea ex-president back in court for criminal trial

-

Thunder crush Grizzlies, Celtics and Cavs open NBA playoffs with wins

-

Beijing slams 'appeasement' of US in trade deals that hurt China

Beijing slams 'appeasement' of US in trade deals that hurt China

-

Trump in his own words: 100 days of quotes

-

Padres say slugger Arraez 'stable' after scary collision

Padres say slugger Arraez 'stable' after scary collision

-

Trump tariffs stunt US toy imports as sellers play for time

-

El Salvador offers to swap US deportees with Venezuela

El Salvador offers to swap US deportees with Venezuela

-

Higgo holds on for win after Dahmen's late collapse

-

Moolec Science Enters Into Transformational Transaction Expanding Across Multiple Technology Platforms

Moolec Science Enters Into Transformational Transaction Expanding Across Multiple Technology Platforms

-

El Salvador's president proposes prisoner exchange with Venezuela

-

Gilgeous-Alexander, Jokic, Antetokounmpo named NBA MVP finalists

Gilgeous-Alexander, Jokic, Antetokounmpo named NBA MVP finalists

-

Thomas ends long wait with playoff win over Novak

-

Thunder rumble to record win over Grizzlies, Celtics top Magic in NBA playoff openers

Thunder rumble to record win over Grizzlies, Celtics top Magic in NBA playoff openers

-

Linesman hit by projectile as Saint-Etienne edge toward safety

-

Mallia guides Toulouse to Top 14 win over Stade Francais

Mallia guides Toulouse to Top 14 win over Stade Francais

-

Israel cancels visas for French lawmakers

-

Russia and Ukraine trade blame over Easter truce, as Trump predicts 'deal'

Russia and Ukraine trade blame over Easter truce, as Trump predicts 'deal'

-

Valverde stunner saves Real Madrid title hopes against Bilbao

What's in Biden's big climate and health bill?

Hundreds of billions of dollars for clean energy projects, cheaper prescription drugs and new corporate taxes are a few of the key items in US President Joe Biden's massive investment plan, which the House of Representatives is expected to pass Friday, after Senate approval.

Here's a closer look at the signature elements of the plan, which could offer the Democratic leader a big political win heading into November's crucial midterm elections.

- $370 billion for clean energy, climate -

If the legislation is passed, it will mark the biggest investment in US history in the fight against climate change.

Rather than attempting to punish the biggest polluters in corporate America, the bill put forward by Biden's party instead proposes a series of financial incentives aimed at steering the world's biggest economy away from fossil fuels.

Tax credits would be given to producers and consumers of wind, solar and nuclear power.

If passed, the legislation would allot up to $7,500 in tax credits to every American who buys an electric vehicle. Anyone installing solar panels on their roof would see 30 percent of the cost subsidized.

Around $60 billion would be allocated for clean energy manufacturing, from wind turbines to the processing of minerals needed for electric car batteries.

The same amount would go towards programs to help drive investment in underprivileged communities, notably through grants for home renovation to improve energy efficiency and access to less polluting modes of transportation.

Huge investments would go into making forests less susceptible to wildfires and protect coastal areas from erosion caused by devastating hurricanes.

The bill aims to help the United States reduce its carbon emissions by 40 percent by 2030, as compared with 2005 levels.

- $64 billion for health care -

The second major aspect of the legislation is to help reduce the huge disparities in access to health care across the United States, notably by reining in skyrocketing prescription drug prices.

If the draft eventually becomes law, Medicare -- the nation's health insurance plan for those aged 65 and older, or with modest incomes -- could be permitted to negotiate prices of certain medications directly with Big Pharma for the first time, likely yielding far better deals.

The plan would require pharmaceutical companies to offer rebates on certain drugs if the prices rise faster than soaring US inflation.

It also would extend benefits under Barack Obama's signature Affordable Care Act -- known colloquially as Obamacare -- until 2025.

- Minimum corporate tax of 15% -

Alongside these huge investments, the so-called "Inflation Reduction Act" would seek to pare down the federal deficit through the adoption of a minimum corporate tax of 15 percent for all companies with profits exceeding one billion dollars.

The new tax seeks to prevent certain huge firms from using tax havens to pay far less than what they theoretically owe.

According to estimates, the measure could generate more than $258 billion in tax revenue for US government coffers over the next 10 years.

S.Keller--BTB