-

EU slaps fines on Apple and Meta, risking Trump fury

EU slaps fines on Apple and Meta, risking Trump fury

-

Gaza rescuers recover charred bodies as Israeli strikes kill 17

-

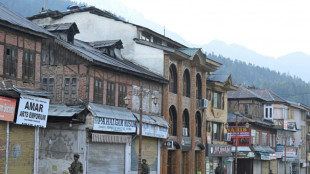

Tourists flee India-administered Kashmir after deadly attack

Tourists flee India-administered Kashmir after deadly attack

-

China says 'door open' to trade talks after Trump signals tariffs will fall

-

WEF confirms investigation into claims against founder Schwab

WEF confirms investigation into claims against founder Schwab

-

Pilgrims flock to pay tribute to pope lying in state

-

Stocks rally as Trump comments ease Fed, China trade fears

Stocks rally as Trump comments ease Fed, China trade fears

-

Muzarabani takes six as Bangladesh set Zimbabwe 174 to win

-

PM faces first test as Singapore election campaign kicks off

PM faces first test as Singapore election campaign kicks off

-

Patients with leprosy face lasting stigma in Ethiopia

-

Still reeling a year on, Brazil's Porto Alegre fears next flood

Still reeling a year on, Brazil's Porto Alegre fears next flood

-

Lakers level NBA playoff series, Pacers and Thunder win again

-

At night, crime and fear stalk DR Congo's M23-run areas

At night, crime and fear stalk DR Congo's M23-run areas

-

Embalming and make-up: Pope's body prepared for lying-in-state

-

Prosecutors to make case against Harvey Weinstein at retrial

Prosecutors to make case against Harvey Weinstein at retrial

-

Coral reefs pushed to brink as bleaching crisis worsens

-

Vietnam village starts over with climate defences after landslide

Vietnam village starts over with climate defences after landslide

-

'Happiness, love' at Moonie mass wedding after Japanese court blow

-

Veteran Chinese astronaut to lead fresh crew to space station

Veteran Chinese astronaut to lead fresh crew to space station

-

Pilgrims gather as Pope Francis begins lying in state

-

Asian markets rally as Trump comments ease Fed, China trade fears

Asian markets rally as Trump comments ease Fed, China trade fears

-

Saudi 'city of roses' offers fragrant reminder of desert's beauty

-

Trump says won't fire Fed chief, signals China tariffs will come down

Trump says won't fire Fed chief, signals China tariffs will come down

-

India hunts gunmen who massacred 26 in Kashmir tourist hotspot

-

'No one else will': Sudan's journalists risk all to report the war

'No one else will': Sudan's journalists risk all to report the war

-

UK hosts new round of Ukraine talks

-

Trial testimony reveals OpenAI interest in Chrome: reports

Trial testimony reveals OpenAI interest in Chrome: reports

-

Tokyo's newest art star: one-year-old Thumbelina

-

Ronaldo hunts Asian Champions League glory in Saudi-hosted finals

Ronaldo hunts Asian Champions League glory in Saudi-hosted finals

-

Scientists sound alarm as Trump reshapes US research landscape

-

Trump's return boosts Israel's pro-settlement right: experts

Trump's return boosts Israel's pro-settlement right: experts

-

Trump solo: first lady, children out of frame in new term

-

Climate watchers fret over Trump's cut to sciences

Climate watchers fret over Trump's cut to sciences

-

Moving fast and breaking everything: Musk's rampage through US govt

-

'Everyday attack' - Trans youth coming of age in Trump's America

'Everyday attack' - Trans youth coming of age in Trump's America

-

A stadium and a jersey for Argentina's 'Captain' Francis

-

New Trump task force vows to root out 'anti-Christian bias'

New Trump task force vows to root out 'anti-Christian bias'

-

96.com Congratulates Burnley FC on Premier League Promotion

-

Auto Shanghai showcases new EV era despite tariff speedbumps

Auto Shanghai showcases new EV era despite tariff speedbumps

-

Trump's administration moves to scrap artificial food dyes

-

Musk to reduce White House role as Tesla profits plunge

Musk to reduce White House role as Tesla profits plunge

-

US official backs off promise to solve cause of autism by September

-

Guardiola joy as Man City go third after dramatic win over Villa

Guardiola joy as Man City go third after dramatic win over Villa

-

Trump says has 'no intention' of firing Fed chief

-

Jury finds New York Times did not libel Sarah Palin

Jury finds New York Times did not libel Sarah Palin

-

UN appoints envoy to assess aid for Palestinians

-

Celtics star Tatum 'doubtful' for game two against Magic

Celtics star Tatum 'doubtful' for game two against Magic

-

Former England star Flintoff reveals mental battle after car crash

-

Defending champion Korda chases first win of season at Chevron Championship

Defending champion Korda chases first win of season at Chevron Championship

-

Olmo fires Liga leaders Barca past Mallorca

Asian markets rally as Trump comments ease Fed, China trade fears

Asian stocks rallied with Wall Street on Wednesday after Donald Trump said he had "no intention" of firing the head of the Federal Reserve and that eye-watering tariffs on China would be slashed drastically.

Global markets, already upended by a trade war, were battered further at the start of the week by fears the US president was looking to remove central bank boss Jerome Powell for not cutting interest rates, calling him a "major loser" and "Mr. Too Late".

Observers warned such a move would have dealt a blow to the Fed's independence and sparked a crisis of confidence in the world's top economy, sparking a sell-off of US assets and another global crisis.

However, Trump looked to temper those fears Tuesday, saying: "I have no intention of firing him."

He added: "I would like to see him be a little more active in terms of his idea to lower interest rates -- it's a perfect time to lower interest rates.

"If he doesn't, is it the end? No."

The remarks gave a much-needed shot of relief to investors, helped by the president's comments later indicating a more conciliatory approach to the trade war with China.

Washington has imposed tariffs of 145 percent on a range of products from China, while Beijing has replied with 125 percent duties on imports from the United States.

But the president on Tuesday acknowledged that the US levies were at a "very high" level, and that this will "come down substantially".

"They will not be anywhere near that number," he said, but added that "it won't be zero".

That came after Treasury Secretary Scott Bessent told a closed-door event in Washington that he expected a de-escalation soon in the United States' tariff standoff with China, which he said was not sustainable.

White House Press Secretary Karoline Leavitt later said "the president and the administration are setting the stage for a deal", noting that "the ball is moving in the right direction".

Investors welcomed the comments with open arms, pushing Tokyo, Hong Kong, Sydney, Seoul and Wellington more than one percent higher, while Taipei rallied more than three percent.

Singapore and Jakarta also rose though Shanghai and Manila edged down.

Gold, which had hit a record high above $3,500 Tuesday on a rush to safety, retreated to sit around $3,370, while the dollar clawed back some of its recent losses against the pound, euro and yen.

The gains followed rallies of more than two percent for all three main indexes in New York.

"While it is still early days, the mood in the market is evidently shifting and what was a strong 'sell America' vibe flowing through markets... has in part reversed," said Chris Weston at Pepperstone.

He added that the president's comments on Powell "should go some way to allaying fears of a major policy mistake".

Investors were unmoved by the International Monetary Fund's decision to slash its global economic growth outlook by 0.5 percentage points to 2.8 percent this year, citing the effect of Trump's tariff policies.

- Key figures at 0230 GMT -

Tokyo - Nikkei 225: UP 1.7 percent at 34,808.80 (break)

Hong Kong - Hang Seng Index: UP 1.7 percent at 21,928.58

Shanghai - Composite: DOWN 0.1 percent at 3,295.44

Euro/dollar: DOWN at $1.1392 from $1.1420 on Tuesday

Pound/dollar: DOWN $1.3305 at $1.3330

Dollar/yen: UP at 142.10 yen from 141.56 yen

Euro/pound: DOWN at 85.61 pence from 85.67 pence

West Texas Intermediate: UP 1.0 percent at $64.28 per barrel

Brent North Sea Crude: UP 0.9 percent at $68.04 per barrel

New York - Dow: UP 2.7 percent at 39,186.98 (close)

London - FTSE 100: UP 0.6 percent at 8,328.60 (close)

R.Flueckiger--VB