-

UK hosts new round of Ukraine talks

UK hosts new round of Ukraine talks

-

Trial testimony reveals OpenAI interest in Chrome: reports

-

Tokyo's newest art star: one-year-old Thumbelina

Tokyo's newest art star: one-year-old Thumbelina

-

Ronaldo hunts Asian Champions League glory in Saudi-hosted finals

-

Scientists sound alarm as Trump reshapes US research landscape

Scientists sound alarm as Trump reshapes US research landscape

-

Trump's return boosts Israel's pro-settlement right: experts

-

Trump solo: first lady, children out of frame in new term

Trump solo: first lady, children out of frame in new term

-

Climate watchers fret over Trump's cut to sciences

-

Moving fast and breaking everything: Musk's rampage through US govt

Moving fast and breaking everything: Musk's rampage through US govt

-

'Everyday attack' - Trans youth coming of age in Trump's America

-

A stadium and a jersey for Argentina's 'Captain' Francis

A stadium and a jersey for Argentina's 'Captain' Francis

-

New Trump task force vows to root out 'anti-Christian bias'

-

Auto Shanghai showcases new EV era despite tariff speedbumps

Auto Shanghai showcases new EV era despite tariff speedbumps

-

Trump's administration moves to scrap artificial food dyes

-

Musk to reduce White House role as Tesla profits plunge

Musk to reduce White House role as Tesla profits plunge

-

US official backs off promise to solve cause of autism by September

-

Guardiola joy as Man City go third after dramatic win over Villa

Guardiola joy as Man City go third after dramatic win over Villa

-

Trump says has 'no intention' of firing Fed chief

-

Jury finds New York Times did not libel Sarah Palin

Jury finds New York Times did not libel Sarah Palin

-

UN appoints envoy to assess aid for Palestinians

-

Celtics star Tatum 'doubtful' for game two against Magic

Celtics star Tatum 'doubtful' for game two against Magic

-

Former England star Flintoff reveals mental battle after car crash

-

Defending champion Korda chases first win of season at Chevron Championship

Defending champion Korda chases first win of season at Chevron Championship

-

Olmo fires Liga leaders Barca past Mallorca

-

Nunes strikes at the death as Man City sink Villa to boost top-five bid

Nunes strikes at the death as Man City sink Villa to boost top-five bid

-

Tesla says profits plunge 71%, warns of 'changing political sentiment'

-

WHO announces 'significant' layoffs amid US funding cuts

WHO announces 'significant' layoffs amid US funding cuts

-

PSG draw with Nantes to stay unbeaten in Ligue 1

-

Trump's administration moves to ban artificial food dyes

Trump's administration moves to ban artificial food dyes

-

Gunmen kill dozens of civilians in Kashmir tourist hotspot

-

US Treasury chief expects China tariff impasse to de-escalate

US Treasury chief expects China tariff impasse to de-escalate

-

I.Coast opposition leader Thiam barred from presidential election

-

Top US court leans toward parents in case on LGBTQ books in schools

Top US court leans toward parents in case on LGBTQ books in schools

-

At least 24 killed in Kashmir attack on tourists

-

Rahul powers Delhi to big win over Lucknow in IPL

Rahul powers Delhi to big win over Lucknow in IPL

-

Colombian cycling star 'Lucho' Herrera denies murder conspiracy

-

Trump, Zelensky to attend Pope Francis's funeral Saturday

Trump, Zelensky to attend Pope Francis's funeral Saturday

-

US State Department to cut positions, rights offices

-

Ukraine ready for direct talks with Russia only after ceasefire: Zelensky

Ukraine ready for direct talks with Russia only after ceasefire: Zelensky

-

Myanmar Catholics mourn pope who remembered their plight

-

Pope's Vatican 'family' pay tearful respects

Pope's Vatican 'family' pay tearful respects

-

The world leaders set to attend Pope Francis's funeral

-

'Like a storm': Witnesses describe deadly Kashmir attack

'Like a storm': Witnesses describe deadly Kashmir attack

-

Volkswagen unveils its electric counter-offensive in China

-

Landmark Nepal survey estimates nearly 400 elusive snow leopards

Landmark Nepal survey estimates nearly 400 elusive snow leopards

-

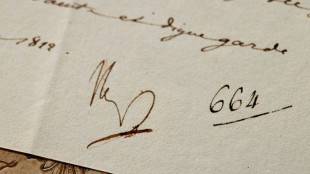

Napoleon letter auction recalls French pope detention

-

Saka injury 'nothing serious' as Arteta weighs Arsenal options

Saka injury 'nothing serious' as Arteta weighs Arsenal options

-

Rubio to cut positions, rights offices at US State Department

-

Trump says 'on the same side of every issue' with Netanyahu after call

Trump says 'on the same side of every issue' with Netanyahu after call

-

ECB's Lagarde hopes Trump won't fire US Fed chief Powell

Wall Street stocks surge on hopes of US-China trade deal

Wall Street stocks rebounded Tuesday on upbeat remarks by US officials about trade talks with China, after gold earlier hit a record on jitters surrounding tariffs and other issues.

All three major US indexes rose by more than two percent following White House Press Secretary Karoline Leavitt's comments that Trump was "setting the stage for a deal with China."

The Dow ended 2.7 percent higher while the broad-based S&P 500 climbed 2.5 percent.

Europe's main indexes logged gains as well, as the region's trading resumed after a long-weekend break for Easter.

Earlier Tuesday, gold reached $3,500 an ounce for the first time as Trump's sweeping tariffs and verbal assault on Federal Reserve policies prompted investors to snap up the safe-haven asset.

Asian indexes closed mixed, while oil prices firmed.

"Looking at today's rebound for equities, you might be forgiven for thinking that financial markets have forgotten all about Trump's threats to fire Powell," said IG analyst Chris Beauchamp, referring to Fed chairman Jerome Powell.

Panicked Wall Street investors dumped US assets on Monday, with all three main indexes ending down around 2.5 percent, after Trump took another in a series of swipes at the Fed chair.

The president last week criticized Powell over the latter's warning that the White House's sweeping levies would likely reignite inflation.

Trump sent shivers through markets Monday by again calling on Powell to make pre-emptive cuts to US interest rates.

The outbursts have fanned concern that Trump is preparing to oust the head of the US central bank. Trump's top economic adviser Kevin Hassett said Friday that the president was looking at whether he could do so.

But Wall Street rebounded strongly on Tuesday.

Briefing.com analyst Patrick O'Hare put part of the rebound down to sentiment that Trump would not fire Powell, and instead was "simply setting him up now to take the blame in the event of an economic downturn."

Markets also climbed after US Treasury Secretary Scott Bessent told a closed-door event in Washington that he expected a de-escalation soon in the United States' tariff standoff with China.

Later in the day, Leavitt told reporters that "the president and the administration are setting the stage for a deal," noting that "the ball is moving in the right direction."

All eyes were on Tesla, too, as the company reported financial results after the closing bell.

It announced a 71-percent drop in first-quarter profits Tuesday, in results that lagged analyst estimates. The electric vehicle producer warned of a hit to demand due to "changing political sentiment."

Tesla shares were up 0.4 percent in after-hours trading.

Its shares have tanked more than 35 percent from the start of the year as Elon Musk's political role in the Trump administration has dented the brand's image. The carmaker has also been caught up in tariff turmoil.

Separately, investors largely shrugged off the International Monetary Fund saying Trump's new tariff policies would take a big bite out of global growth, with many already having factored in their impact.

The IMF now sees the global economy growing by 2.8 percent this year, 0.5 percentage points lower than its previous forecast in January.

- Key figures at 2030 GMT -

New York - Dow: UP 2.7 percent at 39,186.98 points (close)

New York - S&P 500: UP 2.5 percent at 5,287.76 (close)

New York - Nasdaq Composite: UP 2.7 percent at 16,300.42 (close)

London - FTSE 100: UP 0.6 percent at 8,328.60 (close)

Paris - CAC 40: UP 0.6 percent at 7,326.47 (close)

Frankfurt - DAX: UP 0.4 percent at 21,293.53 (close)

Tokyo - Nikkei 225: DOWN 0.2 percent at 34,220.60 (close)

Hong Kong - Hang Seng Index: UP 0.8 percent at 21,562.32 (close)

Shanghai - Composite: UP 0.3 percent at 3,299.76 (close)

Euro/dollar: DOWN at $1.1420 from $1.1510 on Monday

Pound/dollar: DOWN $1.3330 at $1.3377

Dollar/yen: UP at 141.56 yen from 140.89 yen

Euro/pound: DOWN at 85.67 pence from 86.03 pence

Brent North Sea Crude: UP 1.8 percent at $67.44 per barrel

West Texas Intermediate: UP 2.0 percent at $64.31 per barrel

burs-rl-bys/aha

P.Keller--VB