-

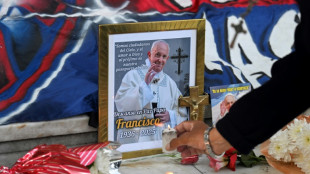

East Timor mourns Pope Francis months after emotional visit

East Timor mourns Pope Francis months after emotional visit

-

US envoy to visit Moscow as US pushes for ceasefire

-

At least 24 killed in Kashmir attack on tourists: Indian police source

At least 24 killed in Kashmir attack on tourists: Indian police source

-

Philippine typhoon victims remember day Pope Francis brought hope

-

IMF slashes global growth outlook on impact of Trump tariffs

IMF slashes global growth outlook on impact of Trump tariffs

-

BASF exits Xinjiang ventures after Uyghur abuse reports

-

Nordics, Lithuania plan joint purchase of combat vehicles

Nordics, Lithuania plan joint purchase of combat vehicles

-

Gold hits record, stocks diverge as Trump fuels Fed fears

-

World could boost growth by reducing trade doubt: IMF chief economist

World could boost growth by reducing trade doubt: IMF chief economist

-

IMF slashes global growth outlook on impact of US tariffs

-

IMF slashes China growth forecasts as trade war deepens

IMF slashes China growth forecasts as trade war deepens

-

Skipper Shanto leads Bangladesh fightback in Zimbabwe Test

-

US VP Vance says 'progress' in India trade talks

US VP Vance says 'progress' in India trade talks

-

Ex-England star Youngs to retire from rugby

-

Black Ferns star Woodman-Wickliffe returning for World Cup

Black Ferns star Woodman-Wickliffe returning for World Cup

-

Kremlin warns against rushing Ukraine talks

-

Mbappe aiming for Copa del Rey final return: Ancelotti

Mbappe aiming for Copa del Rey final return: Ancelotti

-

US universities issue letter condemning Trump's 'political interference'

-

Pope Francis's unfulfilled wish: declaring PNG's first saint

Pope Francis's unfulfilled wish: declaring PNG's first saint

-

Myanmar rebels prepare to hand key city back to junta, China says

-

Hamas team heads to Cairo for Gaza talks as Israel strikes kill 26

Hamas team heads to Cairo for Gaza talks as Israel strikes kill 26

-

Pianist to perform London musical marathon

-

India's Bumrah, Mandhana win top Wisden cricket awards

India's Bumrah, Mandhana win top Wisden cricket awards

-

Zurab Tsereteli, whose monumental works won over Russian elites, dies aged 91

-

Roche says will invest $50 bn in US, as tariff war uncertainty swells

Roche says will invest $50 bn in US, as tariff war uncertainty swells

-

Pope Francis's funeral set for Saturday, world leaders expected

-

US official asserts Trump's agenda in tariff-hit Southeast Asia

US official asserts Trump's agenda in tariff-hit Southeast Asia

-

World leaders set to attend Francis's funeral as cardinals gather

-

Gold hits record, stocks mixed as Trump fuels Fed fears

Gold hits record, stocks mixed as Trump fuels Fed fears

-

Roche says will invest $50 bn in US over next five years

-

Fleeing Pakistan, Afghans rebuild from nothing

Fleeing Pakistan, Afghans rebuild from nothing

-

US Supreme Court to hear case against LGBTQ books in schools

-

Pistons snap NBA playoff skid, vintage Leonard leads Clippers

Pistons snap NBA playoff skid, vintage Leonard leads Clippers

-

Migrants mourn pope who fought for their rights

-

Duplantis kicks off Diamond League amid Johnson-led changing landscape

Duplantis kicks off Diamond League amid Johnson-led changing landscape

-

Taliban change tune towards Afghan heritage sites

-

Kosovo's 'hidden Catholics' baptised as Pope Francis mourned

Kosovo's 'hidden Catholics' baptised as Pope Francis mourned

-

Global warming is a security threat and armies must adapt: experts

-

Can Europe's richest family turn Paris into a city of football rivals?

Can Europe's richest family turn Paris into a city of football rivals?

-

Climate campaigners praise a cool pope

-

As world mourns, cardinals prepare pope's funeral

As world mourns, cardinals prepare pope's funeral

-

US to impose new duties on solar imports from Southeast Asia

-

Draft NZ law seeks 'biological' definition of man, woman

Draft NZ law seeks 'biological' definition of man, woman

-

Auto Shanghai to showcase electric competition at sector's new frontier

-

Tentative tree planting 'decades overdue' in sweltering Athens

Tentative tree planting 'decades overdue' in sweltering Athens

-

Indonesia food plan risks 'world's largest' deforestation

-

Gold hits record, stocks slip as Trump fuels Fed fears

Gold hits record, stocks slip as Trump fuels Fed fears

-

Trump helps enflame anti-LGBTQ feeling from Hungary to Romania

-

Woe is the pinata, a casualty of Trump trade war

Woe is the pinata, a casualty of Trump trade war

-

'Like orphans': Argentina mourns loss of papal son

Asian markets skid into weekend as trade fears cast a pall

Asian markets limped into the weekend on Friday following a tepid lead from Wall Street as the optimism stoked by a dovish US Federal Reserve meeting gave way to long-running fears about President Donald Trump's tariff agenda.

Traders took heart from US central bank boss Jerome Powell's comments that the impact of hefty levies imposed on imports from key partners would likely be transitional and from officials' forecasts that did not see a feared recession this year.

That came days after China unveiled a range of measures aimed at boosting consumer spending and reigniting the world's number two economy.

However, Trump's hardball trade policies continue to cast a dark shadow, keeping sentiment and appetite for risk in check.

With central bank meetings in the United States, Japan, Britain and Sweden passing with little major news and no movement on monetary policy, the main focus is back on tariffs, with the next wave of measures due to kick in at the start of April.

The uncertainty surrounding US policy -- with the White House imposing, delaying and then reimposing levies at the drop of a hat -- has left traders with little choice but to take a step back.

"Equity investors are back focusing on the uncertainty and negative impact that is likely to come from a trade war," said National Australia Bank's Rodrigo Catril. "Sentiment remains fragile with investors nervous and not sure whether to put on risk or take it off.

"Tariff uncertainty, as we await the release of the America First Trade Report due on 2 April, remains the big dark cloud."

In early trade, shares in Hong Kong, Shanghai, Singapore, Taipei and Manila were in negative territory, while Tokyo, Sydney, Seoul and Wellington edged up.

Unease about the outlook continues to push gold prices higher as investors seek out a safe haven from the volatility. The precious metal was on Friday sitting just below the record $3,057.49 per ounce touched Thursday.

Oil prices were also on the way up owing to rising geopolitical tensions as Israel ramps up attacks in Gaza and US forces strike Iran-backed Huthi rebels in Yemen.

News that Washington had sanctioned a China-based oil refinery that purchased Iranian oil worth around $500 million from Huthi-linked ships added to trader concerns.

Since returning to office, Trump has resumed his campaign of "maximum pressure" against Tehran and has already rolled out sanctions against several individuals and entities, including Iran's oil minister.

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: UP 0.4 percent at 37,890.42 (break)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 24,167.75

Shanghai - Composite: DOWN 0.1 percent at 3,406.67

Euro/dollar: DOWN at $1.0854 from $1.0856 on Thursday

Pound/dollar: DOWN at $1.2966 from $1.2967

Dollar/yen: UP at 149.15 yen from 148.76 yen

Euro/pound: UP at 83.74 pence from 83.72 pence

West Texas Intermediate: UP 0.7 percent at $68.51 per barrel

Brent North Sea Crude: UP 0.6 percent at $72.40 per barrel

New York - Dow: DOWN less than 0.1 percent at 41,953.32 points (close)

London - FTSE 100: DOWN less than 0.1 percent at 8,701.99 (close)

C.Koch--VB