-

Climate campaigners praise a cool pope

Climate campaigners praise a cool pope

-

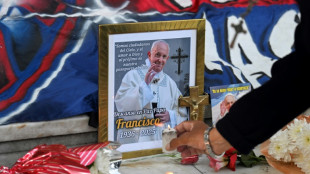

As world mourns, cardinals prepare pope's funeral

-

US to impose new duties on solar imports from Southeast Asia

US to impose new duties on solar imports from Southeast Asia

-

Draft NZ law seeks 'biological' definition of man, woman

-

Auto Shanghai to showcase electric competition at sector's new frontier

Auto Shanghai to showcase electric competition at sector's new frontier

-

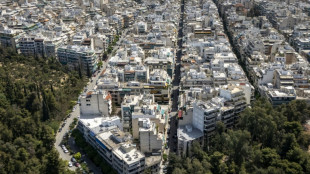

Tentative tree planting 'decades overdue' in sweltering Athens

-

Indonesia food plan risks 'world's largest' deforestation

Indonesia food plan risks 'world's largest' deforestation

-

Gold hits record, stocks slip as Trump fuels Fed fears

-

Trump helps enflame anti-LGBTQ feeling from Hungary to Romania

Trump helps enflame anti-LGBTQ feeling from Hungary to Romania

-

Woe is the pinata, a casualty of Trump trade war

-

'Like orphans': Argentina mourns loss of papal son

'Like orphans': Argentina mourns loss of papal son

-

Trump tariffs torch chances of meeting with China's Xi

-

X rival Bluesky adds blue checks for trusted accounts

X rival Bluesky adds blue checks for trusted accounts

-

China to launch new crewed mission into space this week

-

Morocco volunteers on Sahara clean-up mission

Morocco volunteers on Sahara clean-up mission

-

Latin America fondly farewells its first pontiff

-

'I wanted it to work': Ukrainians disappointed by Easter truce

'I wanted it to work': Ukrainians disappointed by Easter truce

-

Harvard sues Trump over US federal funding cuts

-

'One isn't born a saint': School nuns remember Pope Francis as a boy

'One isn't born a saint': School nuns remember Pope Francis as a boy

-

Battling Forest see off Spurs to boost Champions League hopes

-

'I don't miss tennis' says Nadal

'I don't miss tennis' says Nadal

-

Biles 'not so sure' about competing at Los Angeles Olympics

-

Gang-ravaged Haiti nearing 'point of no return', UN warns

Gang-ravaged Haiti nearing 'point of no return', UN warns

-

US assets slump again as Trump sharpens attack on Fed chief

-

Forest see off Spurs to boost Champions League hopes

Forest see off Spurs to boost Champions League hopes

-

Trump says Pope Francis 'loved the world,' will attend funeral

-

Oscar voters required to view all films before casting ballots

Oscar voters required to view all films before casting ballots

-

Bucks' Lillard upgraded to 'questionable' for game 2 v Pacers

-

Duplantis and Biles win Laureus World Sports Awards

Duplantis and Biles win Laureus World Sports Awards

-

US urges curb of Google's search dominance as AI looms

-

The Pope with 'two left feet' who loved the 'beautiful game'

The Pope with 'two left feet' who loved the 'beautiful game'

-

With Pope Francis death, Trump loses top moral critic

-

Mourning Americans contrast Trump approach to late Pope Francis

Mourning Americans contrast Trump approach to late Pope Francis

-

Leeds and Burnley promoted to Premier League

-

Racist gunman jailed for life over US supermarket massacre

Racist gunman jailed for life over US supermarket massacre

-

Trump backs Pentagon chief despite new Signal chat scandal

-

Macron vows to step up reconstruction in cyclone-hit Mayotte

Macron vows to step up reconstruction in cyclone-hit Mayotte

-

Gill, Sudharsan help toppers Gujarat boss Kolkata in IPL

-

Messi, San Lorenzo bid farewell to football fan Pope Francis

Messi, San Lorenzo bid farewell to football fan Pope Francis

-

Leeds on brink of Premier League promotion after smashing Stoke

-

In Lourdes, Catholic pilgrims mourn the 'pope of the poor'

In Lourdes, Catholic pilgrims mourn the 'pope of the poor'

-

Korir wins men's Boston Marathon, Lokedi upstages Obiri

-

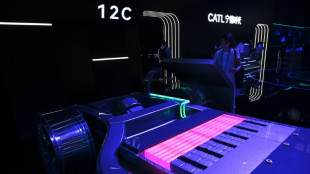

China's CATL launches new EV sodium battery

China's CATL launches new EV sodium battery

-

Korir wins Boston Marathon, Lokedi upstages Obiri

-

Francis, a pope for the internet age

Francis, a pope for the internet age

-

Iraq's top Shiite cleric says Pope Francis sought peace

-

Mourners flock to world's churches to grieve Pope Francis

Mourners flock to world's churches to grieve Pope Francis

-

Trump says Pope Francis 'loved the world'

-

Sri Lanka recalls Pope Francis' compassion on Easter bombing anniversary

Sri Lanka recalls Pope Francis' compassion on Easter bombing anniversary

-

Pope Francis inspired IOC president Bach to create refugee team

European stocks slump at end of volatile week for markets

European stock markets tumbled Friday nearing the end of a highly volatile trading week worldwide as investors assessed the economy's recovery outlook faced with soaring inflation, rising interest rates and mixed earnings.

The week's trading has been dominated by Federal Reserve policy as the US central bank seeks to battle decades-high inflation by embarking on a series of interest rate hikes that could derail strong growth rebounds following pandemic lockdowns.

By contrast, the European Central Bank is sitting tight, putting pressure on the euro which Friday struck a 19-month low versus the dollar.

Rising tensions between Russia and the West over the Ukraine crisis are adding to the fractious mood on trading floors, where a selling frenzy this month wiped around $7 trillion off valuations around the world.

"Downbeat mood rounds up a volatile week for markets," said Victoria Scholar, head of investment at Interactive Investor.

"After an indiscriminate tech rout in recent weeks amid concerns about rising rates from the Fed, earnings season is helping to separate the wheat from the chaff with companies like Apple and Microsoft... managing to buck the broader weakness."

Apple on Thursday reported record quarterly revenue of $124 billion despite a global chip pinch and shifting impacts of the pandemic that have weighed down other big tech players.

Traders were also digesting growth data out of Europe's biggest economies.

The German economy ended 2021 on a downward note, shrinking by 0.7 percent in the fourth quarter as bottlenecks and coronavirus restrictions took their toll, official figures showed.

Last year Germany's economy grew by 2.8 percent, Friday's data added, far slower than its neighbour France, which expanded seven percent in 2021.

While stock markets have rallied for the best part of two years to record or multi-year highs, analysts said a hefty pullback is to be expected, owing to profit-taking and the removal of massive pandemic-era stimulus by central banks and governments.

- Oil gains -

Crude oil prices remained well supported after a strong trading week, aided by the Ukraine-Russia crisis.

"Russia's supply of natural gas to Western Europe could further spark volatility across financial markets, and as we turn the corner on the pandemic we now see a possible conflict as one of the biggest threats to markets in 2022," predicted Federated Hermes analyst Lewis Grant.

On Wall Street, all three main indices ended Thursday in the red, with the Nasdaq leading the way again as tech firms are more susceptible to higher borrowing costs.

- Key figures around 1145 GMT -

London - FTSE 100: DOWN 1.1 percent at 7,467.90 points

Frankfurt - DAX: DOWN 1.9 percent at 15,225.52

Paris - CAC 40: DOWN 1.6 percent at 6,909.83

EURO STOXX 50: DOWN 1.9 percent at 4,105.33

Tokyo - Nikkei 225: UP 2.1 percent at 26,717.34 (close)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 23,550.08 (close)

Shanghai - Composite: DOWN 1.0 percent at 3,361.44 (close)

New York - Dow: FLAT at 34,160.78 (close)

Euro/dollar: DOWN at $1.1132 from $1.1147 late Thursday

Pound/dollar: UP at $1.3387 from $1.3381

Euro/pound: DOWN at 83.15 pence from 83.27 pence

Dollar/yen: UP at 115.59 yen from 115.36 yen

Brent North Sea crude: UP 0.6 percent at $88.70 per barrel

West Texas Intermediate: UP 0.7 percent at $87.22 per barrel

F.Pavlenko--BTB