-

El Salvador rejects US senator's plea to free wrongly deported migrant

El Salvador rejects US senator's plea to free wrongly deported migrant

-

Newcastle thrash Crystal Palace to go third in Premier League

-

Zuckerberg denies Meta bought rivals to conquer them

Zuckerberg denies Meta bought rivals to conquer them

-

Starc stars as Delhi beat Rajasthan in Super Over

-

Weinstein asks to sleep in hospital, citing prison 'mistreatment'

Weinstein asks to sleep in hospital, citing prison 'mistreatment'

-

Amorim asks McIlroy to bring Masters magic to Man Utd

-

Ruud keeps Barcelona Open defence on course

Ruud keeps Barcelona Open defence on course

-

Trump tariffs could put US Fed in a bind, Powell warns

-

CONCACAF chief rejects 64-team World Cup plan for 2030

CONCACAF chief rejects 64-team World Cup plan for 2030

-

Putin praises Musk, compares him to Soviet space hero

-

Son to miss Spurs' Europa League trip to Frankfurt

Son to miss Spurs' Europa League trip to Frankfurt

-

US senator in El Salvador seeking release of wrongly deported migrant

-

Trump tariffs could put the US Fed in a bind, Powell warns

Trump tariffs could put the US Fed in a bind, Powell warns

-

US judge says 'probable cause' to hold Trump admin in contempt

-

India opposition slams graft charges against Gandhis

India opposition slams graft charges against Gandhis

-

Nate Bargatze to host Emmys: organizers

-

US Fed Chair warns of 'tension' between employment, inflation goals

US Fed Chair warns of 'tension' between employment, inflation goals

-

Trump touts trade talks, China calls out tariff 'blackmail'

-

US judge says 'probable cause' to hold govt in contempt over deportations

US judge says 'probable cause' to hold govt in contempt over deportations

-

US eliminates unit countering foreign disinformation

-

Germany sees 'worrying' record dry spell in early 2025

Germany sees 'worrying' record dry spell in early 2025

-

Israel says 30 percent of Gaza turned into buffer zone

-

TikTok tests letting users add informative 'Footnotes'

TikTok tests letting users add informative 'Footnotes'

-

Global uncertainty will 'certainly' hit growth: World Bank president

-

EU lists seven 'safe' countries of origin, tightening asylum rules

EU lists seven 'safe' countries of origin, tightening asylum rules

-

Chelsea fans must 'trust' the process despite blip, says Maresca

-

Rebel rival government in Sudan 'not the answer': UK

Rebel rival government in Sudan 'not the answer': UK

-

Prague zoo breeds near-extinct Brazilian mergansers

-

Macron to meet Rubio, Witkoff amid transatlantic tensions

Macron to meet Rubio, Witkoff amid transatlantic tensions

-

WTO chief says 'very concerned' as tariffs cut into global trade

-

Sports bodies have 'no excuses' on trans rules after court ruling: campaigners

Sports bodies have 'no excuses' on trans rules after court ruling: campaigners

-

Zverev joins Shelton in Munich ATP quarters

-

The Trump adviser who wants to rewrite the global financial system

The Trump adviser who wants to rewrite the global financial system

-

US senator travels to El Salvador over wrongly deported migrant

-

UN watchdog chief says Iran 'not far' from nuclear bomb

UN watchdog chief says Iran 'not far' from nuclear bomb

-

Trump says 'joke' Harvard should be stripped of funds

-

Macron vows punishment for French prison attackers

Macron vows punishment for French prison attackers

-

Canada central bank holds interest rate steady amid tariffs chaos

-

Rubio headed to Paris for Ukraine war talks

Rubio headed to Paris for Ukraine war talks

-

Australian PM vows not to bow to Trump on national interest

-

New attacks target France prison guard cars, home

New attacks target France prison guard cars, home

-

Global trade uncertainty could have 'severe negative consequences': WTO chief

-

Google facing £5 bn UK lawsuit over ad searches: firms

Google facing £5 bn UK lawsuit over ad searches: firms

-

Onana to return in goal for Man Utd against Lyon: Amorim

-

Tiktok bans user behind Gisele Pelicot 'starter kit' meme

Tiktok bans user behind Gisele Pelicot 'starter kit' meme

-

'Put it on': Dutch drive for bike helmets

-

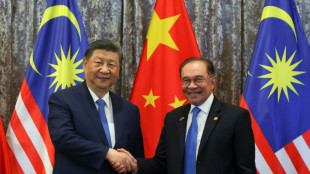

China's Xi meets Malaysian leaders, vows to 'safeguard' Asia allies

China's Xi meets Malaysian leaders, vows to 'safeguard' Asia allies

-

France urges release of jailed Russian journalists who covered Navalny

-

Gabon striker Boupendza dies after 11th floor fall

Gabon striker Boupendza dies after 11th floor fall

-

UK top court rules definition of 'woman' based on sex at birth

Deutsche Bank asset manager DWS fined 25 mn euros for 'greenwashing'

Deutsche Bank's asset management arm DWS was hit Wednesday with a 25-million-euro ($27-million) fine over misleading advertising for supposedly sustainable products, with activists hailing one of the world's biggest ever "greenwashing" penalties.

The case has dogged the German financial firm for several years since a top executive came forward with "greenwashing" allegations, with investigators repeatedly raiding the asset manager's offices and DWS's boss forced to quit in 2022.

It has also highlighted growing worries about how to police a surge in "environmental, social and governance" (ESG) investing as companies and institutions seek to bring portfolios in line with climate targets.

Unveiling the penalty, prosecutors in the German financial capital Frankfurt said DWS had "extensively" advertised financial products which claimed to have ESG characteristics from 2020 to 2023.

But investigations, carried out by prosecutors and police, found that "statements in external communications, such as claiming to be a 'leader' in the ESG area or stating 'ESG is an integral part of our DNA' did not correspond to reality," they said.

While a "transformation process" was underway at the firm, it had not yet been completed, they said, adding: "Statements in external relations must not go beyond what can actually be implemented."

The asset manager said it accepted the fine, admitting that "in the past our marketing was sometimes exuberant" but insisting that improvements had already been made.

DWS had already been hit in 2023 with $19-million penalty by financial regulators in the United States over misleading green statements.

- 'Historically high' fine -

Greenpeace said it was the highest ever penalty imposed in Europe's biggest economy for a such an offence.

"This historically high penalty payment for greenwashing is a clear wake-up call for the entire industry: consumer deception is not a trivial offence but fraud," said Mauricio Vargas, a financial expert with the environmental advocacy group.

He accused DWS of scaling back its sustainable finance efforts in response to the allegations, which he described as a "slap in the face to its customers", and also of continuing to invest heavily in fossil fuels.

The "greenwashing" scandal first emerged at DWS after its former chief sustainability officer, Desiree Fixler, came forward with "greenwashing" allegations in 2021.

Several raids followed at the asset manager and Deutsche Bank's offices in Frankfurt, and DWS chief executive Asoka Woehrmann stepped down in June 2022, saying the allegations had become a "burden".

While ESG products have in recent years become a major asset class, critics worry about what they say is a lack of standardised data and criteria to prove such investments are truly sustainable.

The European Union's markets authority last year issued new rules to combat "greenwashing" in finance, laying out what criteria needed to be met for a fund to have "ESG" or "sustainable" in its name.

Troubles at its asset management arm are also another blow to Deutsche Bank, which has undergone a major restructuring in recent years after an aggressive shift in the early 2000s into investment banking drew it into multiple scandals.

P.Keller--VB