-

Zuckerberg denies Meta bought rivals to conquer them

Zuckerberg denies Meta bought rivals to conquer them

-

Starc stars as Delhi beat Rajasthan in Super Over

-

Weinstein asks to sleep in hospital, citing prison 'mistreatment'

Weinstein asks to sleep in hospital, citing prison 'mistreatment'

-

Amorim asks McIlroy to bring Masters magic to Man Utd

-

Ruud keeps Barcelona Open defence on course

Ruud keeps Barcelona Open defence on course

-

Trump tariffs could put US Fed in a bind, Powell warns

-

CONCACAF chief rejects 64-team World Cup plan for 2030

CONCACAF chief rejects 64-team World Cup plan for 2030

-

Putin praises Musk, compares him to Soviet space hero

-

Son to miss Spurs' Europa League trip to Frankfurt

Son to miss Spurs' Europa League trip to Frankfurt

-

US senator in El Salvador seeking release of wrongly deported migrant

-

Trump tariffs could put the US Fed in a bind, Powell warns

Trump tariffs could put the US Fed in a bind, Powell warns

-

US judge says 'probable cause' to hold Trump admin in contempt

-

India opposition slams graft charges against Gandhis

India opposition slams graft charges against Gandhis

-

Nate Bargatze to host Emmys: organizers

-

US Fed Chair warns of 'tension' between employment, inflation goals

US Fed Chair warns of 'tension' between employment, inflation goals

-

Trump touts trade talks, China calls out tariff 'blackmail'

-

US judge says 'probable cause' to hold govt in contempt over deportations

US judge says 'probable cause' to hold govt in contempt over deportations

-

US eliminates unit countering foreign disinformation

-

Germany sees 'worrying' record dry spell in early 2025

Germany sees 'worrying' record dry spell in early 2025

-

Israel says 30 percent of Gaza turned into buffer zone

-

TikTok tests letting users add informative 'Footnotes'

TikTok tests letting users add informative 'Footnotes'

-

Global uncertainty will 'certainly' hit growth: World Bank president

-

EU lists seven 'safe' countries of origin, tightening asylum rules

EU lists seven 'safe' countries of origin, tightening asylum rules

-

Chelsea fans must 'trust' the process despite blip, says Maresca

-

Rebel rival government in Sudan 'not the answer': UK

Rebel rival government in Sudan 'not the answer': UK

-

Prague zoo breeds near-extinct Brazilian mergansers

-

Macron to meet Rubio, Witkoff amid transatlantic tensions

Macron to meet Rubio, Witkoff amid transatlantic tensions

-

WTO chief says 'very concerned' as tariffs cut into global trade

-

Sports bodies have 'no excuses' on trans rules after court ruling: campaigners

Sports bodies have 'no excuses' on trans rules after court ruling: campaigners

-

Zverev joins Shelton in Munich ATP quarters

-

The Trump adviser who wants to rewrite the global financial system

The Trump adviser who wants to rewrite the global financial system

-

US senator travels to El Salvador over wrongly deported migrant

-

UN watchdog chief says Iran 'not far' from nuclear bomb

UN watchdog chief says Iran 'not far' from nuclear bomb

-

Trump says 'joke' Harvard should be stripped of funds

-

Macron vows punishment for French prison attackers

Macron vows punishment for French prison attackers

-

Canada central bank holds interest rate steady amid tariffs chaos

-

Rubio headed to Paris for Ukraine war talks

Rubio headed to Paris for Ukraine war talks

-

Australian PM vows not to bow to Trump on national interest

-

New attacks target France prison guard cars, home

New attacks target France prison guard cars, home

-

Global trade uncertainty could have 'severe negative consequences': WTO chief

-

Google facing £5 bn UK lawsuit over ad searches: firms

Google facing £5 bn UK lawsuit over ad searches: firms

-

Onana to return in goal for Man Utd against Lyon: Amorim

-

Tiktok bans user behind Gisele Pelicot 'starter kit' meme

Tiktok bans user behind Gisele Pelicot 'starter kit' meme

-

'Put it on': Dutch drive for bike helmets

-

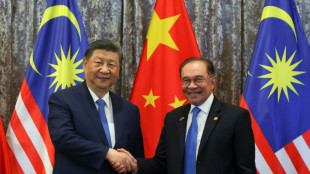

China's Xi meets Malaysian leaders, vows to 'safeguard' Asia allies

China's Xi meets Malaysian leaders, vows to 'safeguard' Asia allies

-

France urges release of jailed Russian journalists who covered Navalny

-

Gabon striker Boupendza dies after 11th floor fall

Gabon striker Boupendza dies after 11th floor fall

-

UK top court rules definition of 'woman' based on sex at birth

-

PSG keep Champions League bid alive, despite old ghosts reappearing

PSG keep Champions League bid alive, despite old ghosts reappearing

-

Stocks retreat as US hits Nvidia chip export to China

Clean energy giant Goldwind leads China's global sector push

China has rushed ahead in recent years as the world's forerunner in wind energy, propelled by explosive local demand as Beijing aggressively pursues strategic and environmental targets.

Goldwind -- the country's sector champion -- is set to publish financial results for last year on Friday, offering a window into how its domestic operations and overseas expansion efforts are faring.

AFP looks at how Goldwind and its Chinese peers turned the country into the indisputable global superpower in wind:

- Recent gusts -

China has been a major player in global installed wind capacity since the late 2000s but it is only in the past few years that it has surged to the top.

Companies from mainland China accounted for six of the top seven turbine manufacturers worldwide last year, according to a report this month by BloombergNEF.

Goldwind held the top spot, followed by three more Chinese firms -- the first time European and US firms all ranked below third.

The country's global wind energy layout is lopsided, however, with the majority of its firms' growth driven by domestic demand.

"The market for wind turbines outside of China is still quite diversified," Lauri Myllyvirta, lead analyst at the Centre for Research on Energy and Clean Air (CREA), told AFP.

The situation "can stay that way if countries concerned about excessive reliance on China create the conditions for the non-Chinese suppliers to expand capacity", he added.

- Overcapacity concerns -

China's wind energy boom has fuelled fears in Western countries that a flood of cheap imports will undercut local players, including Denmark's Vestas and GE Vernova of the United States.

A report in January by the Organisation for Economic Cooperation and Development (OECD) showed Chinese wind turbine manufacturers have for decades received significantly higher levels of state subsidies than member countries.

Western critics argue that the extensive support from Beijing to spur on the domestic wind industry have led to an unfair advantage.

The European Union last April said it would investigate subsidies received by Chinese firms that exported turbines to the continent.

"We cannot allow China's overcapacity issues to distort Europe's established market for wind energy," said Phil Cole, Director of Industrial Affairs at WindEurope, a Brussels-based industry group, in response to the recent OECD report.

"Without European manufacturing and a strong European supply chain, we lose our ability to produce the equipment we need -- and ultimately our energy and national security," said Cole.

- Gold rush -

Goldwind's origin lies in the vast, arid stretches of western China, where in the 1980s a company named Xinjiang Wind Energy built its first turbine farm.

Engineer-turned-entrepreneur Wu Gang soon joined, helping transform the fledgling firm into a pioneer in China's wind energy sector, establishing Goldwind in 1998.

"Goldwind was there from the beginning," said Andrew Garrad, co-founder of Garrad Hassan, a British engineering consultancy that had early engagement with China's wind industry.

"The West was looking at China as an impoverished place in need of help," Garrad told AFP.

"It wasn't, then, an industrial power to be reckoned with."

Garrad, whose company once sold technology to several Chinese wind energy startups including Goldwind, remembers Wu paying him a visit in Bristol during the early 1990s to talk business.

The two spent three days negotiating a software sale for around £10,000 -- a sum "which, for both of us at the time, was worth having", recalled Garrad.

"He didn't have any money at all, and so he was staying at the youth hostel, sharing a room with five other people," he said.

Wu's firm would go on to strike gold, emerging in this century as a global leader in wind turbine technology and installed capacity.

- Global future? -

In recent years, as China's wind market matures, state subsidies are cut and the economy faces downward pressure, Goldwind has increasingly been looking overseas.

In 2023, the firm dropped "Xinjiang" from its official name.

The move was interpreted as an attempt to disassociate from the troubled region, where Beijing is accused of large-scale human rights abuses.

It was also seen as adopting a more outward-facing and international identity.

China's wind power manufacturers are making some headway overseas, particularly in emerging and developing countries, said Myllyvirta of the CREA.

This is particularly true "after Western manufacturers were hit by supply chain disruptions and major input prices due to Covid and Russia's invasion of Ukraine", he added.

Emerging markets affiliated with Beijing's "Belt and Road" development push seem to offer Chinese players the best chance at overseas growth, Endri Lico, analyst at Wood Mackenzie, told AFP.

"Chinese strength comes from scale... and strategic control over domestic supply chains and raw material resources," said Lico.

Western markets remain strongholds for local players, however, "due to entrenched positions, energy security concerns and protectionist policies", he added.

S.Gantenbein--VB