-

Rubio headed to Paris for Ukraine war talks

Rubio headed to Paris for Ukraine war talks

-

Australian PM vows not to bow to Trump on national interest

-

New attacks target France prison guard cars, home

New attacks target France prison guard cars, home

-

Global trade uncertainty could have 'severe negative consequences': WTO chief

-

Google facing £5 bn UK lawsuit over ad searches: firms

Google facing £5 bn UK lawsuit over ad searches: firms

-

Onana to return in goal for Man Utd against Lyon: Amorim

-

Tiktok bans user behind Gisele Pelicot 'starter kit' meme

Tiktok bans user behind Gisele Pelicot 'starter kit' meme

-

'Put it on': Dutch drive for bike helmets

-

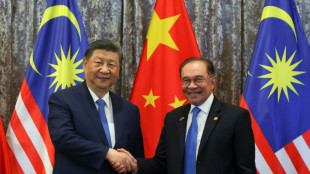

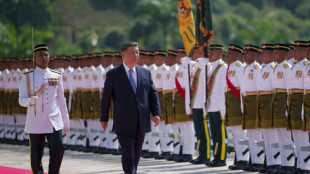

China's Xi meets Malaysian leaders, vows to 'safeguard' Asia allies

China's Xi meets Malaysian leaders, vows to 'safeguard' Asia allies

-

France urges release of jailed Russian journalists who covered Navalny

-

Gabon striker Boupendza dies after 11th floor fall

Gabon striker Boupendza dies after 11th floor fall

-

UK top court rules definition of 'woman' based on sex at birth

-

PSG keep Champions League bid alive, despite old ghosts reappearing

PSG keep Champions League bid alive, despite old ghosts reappearing

-

Stocks retreat as US hits Nvidia chip export to China

-

China's Xi meets Malaysian leaders in diplomatic charm offensive

China's Xi meets Malaysian leaders in diplomatic charm offensive

-

Israel says no humanitarian aid will enter Gaza

-

Anxiety clouds Easter for West Bank Christians

Anxiety clouds Easter for West Bank Christians

-

Pocket watch found on Titanic victim to go on sale in UK

-

UK top court rules definition of 'a woman' based on sex at birth

UK top court rules definition of 'a woman' based on sex at birth

-

All Black Ioane to join Leinster on six-month 'sabbatical'

-

Barca suffer morale blow in Dortmund amid quadruple hunt

Barca suffer morale blow in Dortmund amid quadruple hunt

-

China tells Trump to 'stop threatening and blackmailing'

-

Iran FM says uranium enrichment 'non-negotiable' after Trump envoy urged halt

Iran FM says uranium enrichment 'non-negotiable' after Trump envoy urged halt

-

Automakers hold their breath on Trump's erratic US tariffs

-

Cycling fan admits throwing bottle at Van der Poel was 'stupid'

Cycling fan admits throwing bottle at Van der Poel was 'stupid'

-

Troubled Red Bull search for path back to fast lane

-

China's forecast-beating growth belies storm clouds ahead: analysts

China's forecast-beating growth belies storm clouds ahead: analysts

-

ASML CEO sees growing economic 'uncertainty' from tariffs

-

Heineken beer sales dip, tariffs add to uncertainty

Heineken beer sales dip, tariffs add to uncertainty

-

Rehab centre for Russian veterans from Ukraine fills up

-

Dutch flower industry grasps thorny pesticide issue

Dutch flower industry grasps thorny pesticide issue

-

Solar boom counters power shortages in Niger

-

Malnourished children in Afghanistan at 'high risk of dying' without US aid

Malnourished children in Afghanistan at 'high risk of dying' without US aid

-

Skating comeback queen Liu says she can get even better for Olympics

-

'Let's rock': world music icon Youssou N'Dour back on the road

'Let's rock': world music icon Youssou N'Dour back on the road

-

Mackerel and missiles: EU-UK defence deal snags on fish

-

Istanbul's Hagia Sophia prepares for next big quake

Istanbul's Hagia Sophia prepares for next big quake

-

'Magician' Chahal casts spell with IPL heroics

-

WHO countries strike landmark agreement on tackling future pandemics

WHO countries strike landmark agreement on tackling future pandemics

-

Kerr salutes Harvard defiance over Trump after Warriors win

-

Canada party leaders hold high-stakes debate two weeks from vote

Canada party leaders hold high-stakes debate two weeks from vote

-

As war grinds on, Ukraine's seniors suffer

-

ASML CEO sees 'increased macro uncertainty' from tariffs

ASML CEO sees 'increased macro uncertainty' from tariffs

-

Pope leaves faithful guessing over Easter appearances

-

Butler, 'Batman' Curry shine as Warriors down Grizzlies to reach playoffs

Butler, 'Batman' Curry shine as Warriors down Grizzlies to reach playoffs

-

Skating 'Quad God' Malinin ready for Olympic favourite tag

-

Toppmoeller has ascendant Frankfurt challenging their limits

Toppmoeller has ascendant Frankfurt challenging their limits

-

Cambodia's Chinese casino city bets big on Beijing

-

Vespa love affair: Indonesians turn vintage scooters electric

Vespa love affair: Indonesians turn vintage scooters electric

-

Europe seeks to break its US tech addiction

Asian stocks mixed as stability returns, autos lifted by exemption hope

Asian stocks were mixed Tuesday as some stability returned to markets after last week's rollercoaster ride, with auto firms boosted by Donald Trump's possible compromise over steep tariffs on the sector.

However, the US president's unorthodox approach to trade diplomacy continues to fuel uncertainty among investors, with speculation over new levies on high-end technology and pharmaceuticals dampening sentiment.

The announcement last week of exemptions for smartphones, laptops, semiconductors and other electronics -- all key Chinese-made products -- provided a little comfort, though Trump's suggestion they would be temporary tempered the optimism.

Traders gave a muted reaction to Treasury Secretary Scott Bessent's remarks Monday that a China-US deal could be done in an apparent olive branch as the two economic powerhouses trade tariff threats.

His comments came as Trump has hammered China with duties of up to 145 percent, while Beijing has imposed retaliatory measures of 125 percent.

"There's a big deal to be done at some point" Bessent said when asked by Bloomberg TV about the possibility that the world's largest economies would decouple. "There doesn't have to be" decoupling, he said, "but there could be."

Meanwhile, Trump aide Kevin Hassett said the White House had received "more than 10 deals where there's very, very good, amazing offers made to us", but did not specify which countries.

After a broadly positive day on Wall Street, Asian markets fluctuated.

Tokyo and Seoul were among the best performers thanks to a rally in autos after Trump said he was "very flexible" and "looking at something to help some of the car companies" hit by his 25 percent tariff on all imports.

Toyota and Mazda jumped five percent and Nissan more than three percent, while Seoul-listed Hyundai jumped more than four percent.

South Korea's announcement of plans to invest an additional $4.9 billion in the country's semiconductor sector gave a little lift to chip giants Samsung and SK hynix.

Sydney, Singapore, Taipei, Manila and Jakarta also rose. Hong Kong and Shanghai dipped with Wellington.

Federal Reserve governor Christopher Waller provided some support to markets after suggesting he would back the central bank to cut interest rates to help the economy, instead of focusing on higher inflation.

He pointed out that prices could see a transitory rise because of the tariffs but added that if Trump reverted to the crippling tariffs included in his "Liberation Day" on April 2 then officials would be ready to step in.

"If the slowdown is significant and even threatens a recession, then I would expect to favour cutting the... policy rate sooner, and to a greater extent than I had previously thought," he said in comments prepared for an event Monday.

"In my February speech, I referred to this as the world of 'bad news' rate cuts. With a rapidly slowing economy, even if inflation is running well above two percent, I expect the risk of recession would outweigh the risk of escalating inflation, especially if the effects of tariffs in raising inflation are expected to be short lived."

However, OANDA senior market analyst Kelvin Wong warned central bankers would face some tough choices.

"Combination of slowing growth and persistent inflation, hallmarks of a stagflation environment, poses a significant challenge for the US Federal Reserve, which may find it increasingly difficult to implement counter-cyclical monetary policies to support the economy," he said in a commentary.

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: UP 0.9 percent at 34,285.02 (break)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 21,379.50

Shanghai - Composite: DOWN 0.3 percent at 3,254.04

Dollar/yen: UP at 143.32 yen from 143.09 yen on Monday

Euro/dollar: DOWN at $1.1327 from $1.1356

Pound/dollar: DOWN at $1.3179 from $1.3189

Euro/pound: DOWN at 85.94 pence from 86.08 pence

West Texas Intermediate: UP 0.3 percent at $61.69 per barrel

Brent North Sea Crude: UP 0.2 percent at $65.03 per barrel

New York - Dow: UP 0.8 percent at 40,524.79 (close)

London - FTSE 100: UP 2.1 percent at 8,134.34

L.Stucki--VB