-

Rubio headed to Paris for Ukraine war talks

Rubio headed to Paris for Ukraine war talks

-

Australian PM vows not to bow to Trump on national interest

-

New attacks target France prison guard cars, home

New attacks target France prison guard cars, home

-

Global trade uncertainty could have 'severe negative consequences': WTO chief

-

Google facing £5 bn UK lawsuit over ad searches: firms

Google facing £5 bn UK lawsuit over ad searches: firms

-

Onana to return in goal for Man Utd against Lyon: Amorim

-

Tiktok bans user behind Gisele Pelicot 'starter kit' meme

Tiktok bans user behind Gisele Pelicot 'starter kit' meme

-

'Put it on': Dutch drive for bike helmets

-

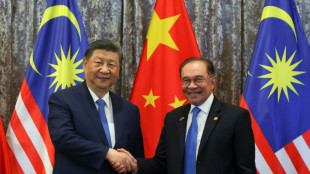

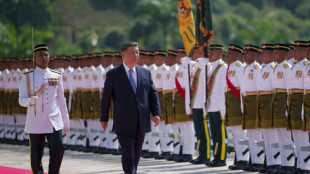

China's Xi meets Malaysian leaders, vows to 'safeguard' Asia allies

China's Xi meets Malaysian leaders, vows to 'safeguard' Asia allies

-

France urges release of jailed Russian journalists who covered Navalny

-

Gabon striker Boupendza dies after 11th floor fall

Gabon striker Boupendza dies after 11th floor fall

-

UK top court rules definition of 'woman' based on sex at birth

-

PSG keep Champions League bid alive, despite old ghosts reappearing

PSG keep Champions League bid alive, despite old ghosts reappearing

-

Stocks retreat as US hits Nvidia chip export to China

-

China's Xi meets Malaysian leaders in diplomatic charm offensive

China's Xi meets Malaysian leaders in diplomatic charm offensive

-

Israel says no humanitarian aid will enter Gaza

-

Anxiety clouds Easter for West Bank Christians

Anxiety clouds Easter for West Bank Christians

-

Pocket watch found on Titanic victim to go on sale in UK

-

UK top court rules definition of 'a woman' based on sex at birth

UK top court rules definition of 'a woman' based on sex at birth

-

All Black Ioane to join Leinster on six-month 'sabbatical'

-

Barca suffer morale blow in Dortmund amid quadruple hunt

Barca suffer morale blow in Dortmund amid quadruple hunt

-

China tells Trump to 'stop threatening and blackmailing'

-

Iran FM says uranium enrichment 'non-negotiable' after Trump envoy urged halt

Iran FM says uranium enrichment 'non-negotiable' after Trump envoy urged halt

-

Automakers hold their breath on Trump's erratic US tariffs

-

Cycling fan admits throwing bottle at Van der Poel was 'stupid'

Cycling fan admits throwing bottle at Van der Poel was 'stupid'

-

Troubled Red Bull search for path back to fast lane

-

China's forecast-beating growth belies storm clouds ahead: analysts

China's forecast-beating growth belies storm clouds ahead: analysts

-

ASML CEO sees growing economic 'uncertainty' from tariffs

-

Heineken beer sales dip, tariffs add to uncertainty

Heineken beer sales dip, tariffs add to uncertainty

-

Rehab centre for Russian veterans from Ukraine fills up

-

Dutch flower industry grasps thorny pesticide issue

Dutch flower industry grasps thorny pesticide issue

-

Solar boom counters power shortages in Niger

-

Malnourished children in Afghanistan at 'high risk of dying' without US aid

Malnourished children in Afghanistan at 'high risk of dying' without US aid

-

Skating comeback queen Liu says she can get even better for Olympics

-

'Let's rock': world music icon Youssou N'Dour back on the road

'Let's rock': world music icon Youssou N'Dour back on the road

-

Mackerel and missiles: EU-UK defence deal snags on fish

-

Istanbul's Hagia Sophia prepares for next big quake

Istanbul's Hagia Sophia prepares for next big quake

-

'Magician' Chahal casts spell with IPL heroics

-

WHO countries strike landmark agreement on tackling future pandemics

WHO countries strike landmark agreement on tackling future pandemics

-

Kerr salutes Harvard defiance over Trump after Warriors win

-

Canada party leaders hold high-stakes debate two weeks from vote

Canada party leaders hold high-stakes debate two weeks from vote

-

As war grinds on, Ukraine's seniors suffer

-

ASML CEO sees 'increased macro uncertainty' from tariffs

ASML CEO sees 'increased macro uncertainty' from tariffs

-

Pope leaves faithful guessing over Easter appearances

-

Butler, 'Batman' Curry shine as Warriors down Grizzlies to reach playoffs

Butler, 'Batman' Curry shine as Warriors down Grizzlies to reach playoffs

-

Skating 'Quad God' Malinin ready for Olympic favourite tag

-

Toppmoeller has ascendant Frankfurt challenging their limits

Toppmoeller has ascendant Frankfurt challenging their limits

-

Cambodia's Chinese casino city bets big on Beijing

-

Vespa love affair: Indonesians turn vintage scooters electric

Vespa love affair: Indonesians turn vintage scooters electric

-

Europe seeks to break its US tech addiction

China's economy likely grew 5.1% in Q1 on export surge: AFP poll

China is expected to post first-quarter growth of around five percent on Wednesday, buoyed by exporters rushing to stave off higher US tariffs but still weighed by sluggish domestic consumption, analysts say.

Beijing and Washington are locked in a fast-moving, high-stakes game of brinkmanship since US President Donald Trump launched a global tariff assault that has particularly targeted Chinese imports.

Tit-for-tat exchanges have seen US levies imposed on China rise to 145 percent, and Beijing setting a retaliatory 125 percent toll on US imports.

Official data Wednesday will offer a first glimpse into how those trade war fears are affecting the Asian giant's fragile economic recovery, which was already feeling the pressure of persistently low consumption and a property market debt crisis.

Analysts polled by AFP forecast the world's number two economy to have grown 5.1 percent from January to March -- down from 5.4 the previous quarter.

Figures released Monday showed Beijing's exports soared more than 12 percent on-year in March, smashing expectations, with analysts attributed it to a "frontloading" of orders ahead of Trump's so-called "Liberation Day" tariffs on April 2.

They also expect that to have boosted economic growth in the first quarter.

However, they warned the GDP reading may prove to be a rare bright spot in a year that promises more woe for the world's second-largest economy.

"China's economy is facing pressure on multiple fronts," Sarah Tan, an economist at Moody's Analytics, said.

"The export bright spot is fading as tariff hikes from the US took effect," she added.

"Domestic demand remains sluggish amid elevated unemployment and a property market stuck in correction," Tan said.

The first quarter was likely "quite good", Alicia Garcia-Herrero, Asia Pacific chief economist at Natixis, told AFP, but the second "will be much worse".

She pointed to "lots of additional exports to the US to avoid additional tariffs".

Also helping to prop up results during the period was the increased consumption during Lunar New Year celebrations when millions of people travelled back to their hometowns, she said.

- Help wanted -

Beijing announced a string of aggressive measures to reignite the economy last year, including interest rate cuts, cancelling restrictions on homebuying, hiking the debt ceiling for local governments and bolstering support for financial markets.

But after a blistering market rally last year fuelled by hopes for a long-awaited "bazooka stimulus", optimism waned as authorities refrained from providing a specific figure for the bailout or fleshing out any of the pledges.

And analysts expect Beijing to jump in with extra support to cushion the tariff pain.

Key to that will be stabilising the long-suffering real estate services sector, which now makes up six percent of GDP, according to analyst Guo Shan.

"If China could withstand its real estate adjustment in the past three years, it should be able to manage the US tariffs, especially if it can stabilise the real estate sector this year," Guo, a partner with Chinese consultancy firm Hutong Research, told AFP.

Tan at Moody's Analytics also said she expected Beijing to pull fiscal and monetary levers this year.

"The government will roll out more stimulus targeted towards households, and the People's Bank of China will likely slash key lending rates," she added.

China is trying to tariff-proof its economy by boosting consumption and investing in key industries.

But the escalating rift between the two countries could hit hundreds of billions of dollars in trade and batter a key economic pillar made even more vital in the absence of vigorous domestic demand.

"Against this backdrop, we consider significant downside risk to China's GDP growth," ANZ analysts wrote in a note.

An "extreme scenario" would be China experiencing another external shock like it did in the 2008 financial crisis, analysts said.

Growth in the second quarter would likely be worse given the tariff dynamics, Guo told AFP.

"Exports will decline, and investment may also slow as uncertainties affect companies' decision making," Guo said.

China's top leaders last month set an ambitious annual growth target of around five percent, vowing to make domestic demand its main economic driver.

Many economists consider that goal to be ambitious given the problems facing the economy.

M.Schneider--VB