-

WHO countries reach landmark agreement on tackling future pandemics

WHO countries reach landmark agreement on tackling future pandemics

-

Stocks struggle again as Nvidia chip curb warning pops calm

-

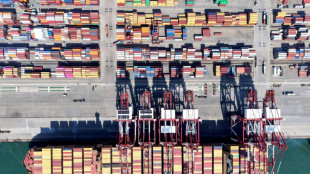

China's economy beats forecasts ahead of Trump's 'Liberation Day'

China's economy beats forecasts ahead of Trump's 'Liberation Day'

-

China's economy beat forecasts in first quarter ahead of Trump's 'Liberation Day'

-

Trump orders critical minerals probe that may bring new tariffs

Trump orders critical minerals probe that may bring new tariffs

-

Onana faces date with destiny as Man Utd chase Lyon win

-

Lessons in horror with Cambodia's Khmer Rouge tribunal

Lessons in horror with Cambodia's Khmer Rouge tribunal

-

Pandemic agreement: key points

-

Paramilitaries declare rival government as Sudan war hits two-year mark

Paramilitaries declare rival government as Sudan war hits two-year mark

-

Landmark agreement reached at WHO over tackling future pandemics

-

'La bolita,' Cuban lottery offering hope in tough times

'La bolita,' Cuban lottery offering hope in tough times

-

'Toxic beauty': Rise of 'looksmaxxing' influencers

-

Facebook added 'value' to Instagram, Zuckerberg tells antitrust trial

Facebook added 'value' to Instagram, Zuckerberg tells antitrust trial

-

Trump signs order aimed at lowering drug prices

-

Paramilitaries declare rival government as Sudan war enters third year

Paramilitaries declare rival government as Sudan war enters third year

-

Nvidia expects $5.5 bn hit as US targets chips sent to China

-

Emery targets 'next step' for Aston Villa after Champions League heroics

Emery targets 'next step' for Aston Villa after Champions League heroics

-

'Gap too big' for Dortmund after first leg, says Guirassy

-

Maradona's daughter says doctors could have prevented his death

Maradona's daughter says doctors could have prevented his death

-

Barcelona 'justified' semi-final spot despite Dortmund loss, says Flick

-

'We thought the tie was over': Dembele admits PSG switched off against Villa

'We thought the tie was over': Dembele admits PSG switched off against Villa

-

Wine consumption falls heavily into the red

-

Barca through to Champions League semis despite Guirassy hat-trick

Barca through to Champions League semis despite Guirassy hat-trick

-

Global stocks mixed amid lingering unease over trade war

-

PSG survive Aston Villa scare to reach Champions League semis

PSG survive Aston Villa scare to reach Champions League semis

-

Pandemic treaty talks fight late hurdles

-

Trump resurrects ghost of US military bases in Panama

Trump resurrects ghost of US military bases in Panama

-

Family seeks homicide charges against owners of collapsed Dominican nightclub

-

Sudan paramilitary chief declares rival government two years into war

Sudan paramilitary chief declares rival government two years into war

-

Boeing faces fresh crisis with US-China trade war

-

Trump eyes slashing State Department by 50 percent: US media

Trump eyes slashing State Department by 50 percent: US media

-

Canada offers automakers tariff relief, Honda denies weighing move

-

Facebook added 'value' to Instagram, Zuckerberg says in antitrust trial

Facebook added 'value' to Instagram, Zuckerberg says in antitrust trial

-

French Ligue 1 clubs vote to break TV deal with DAZN

-

Peru court sentences ex-president Humala to 15 years for graft

Peru court sentences ex-president Humala to 15 years for graft

-

Sumy buries mother and daughter victims of Russian double strike

-

Trump says ball in China's court on tariffs

Trump says ball in China's court on tariffs

-

Kane urges Bayern to hit the mark against Inter in Champions League

-

Trump ramps up conflict against defiant Harvard

Trump ramps up conflict against defiant Harvard

-

Arteta feeding Arsenal stars 'opposite' of comeback message

-

France's Macron honours craftspeople who rebuilt Notre Dame

France's Macron honours craftspeople who rebuilt Notre Dame

-

Watkins left on Villa bench for PSG return

-

Chahal stars as Punjab defend IPL's lowest total of 111 in 'best win'

Chahal stars as Punjab defend IPL's lowest total of 111 in 'best win'

-

French swim star Marchand considered taking year-long break

-

Chahal stars as Punjab defend IPL's lowest total of 111

Chahal stars as Punjab defend IPL's lowest total of 111

-

Universal Studios, Venice Beach to host LA 2028 events

-

IOM chief urges world to step up aid for Haiti

IOM chief urges world to step up aid for Haiti

-

French prisons hit by mystery arson and gunfire attacks

-

Alcaraz follows Ruud into Barcelona Open last 16

Alcaraz follows Ruud into Barcelona Open last 16

-

Stocks rise on bank earnings, auto tariff hopes

Goldman Sachs profits rise on strong equity trading results

Goldman Sachs reported Monday higher first-quarter profits on strength in equity trading, offsetting a hit from losses in investments on public stock markets.

The investment giant reported $4.6 billion in profits to common shareholders, 16.6 percent above the year-ago level in results that topped analyst expectations.

Revenues were $15.1 billion, up six percent.

Chief Executive David Solomon said the Wall Street heavyweight was sticking close to its powerful client base as the Trump administration's constantly changing trade policy reverberates through markets and weakens the near-term US growth outlook.

"I know there is a higher level of uncertainty, but at the same point, clients are active," Solomon said on a conference call with analysts. "People are shifting positions, and we still see significant activity levels."

The forecasts from Goldman Sachs economists for US growth have "fallen meaningfully," said Solomon, who said the chance of a recession "has increased."

"How policies will evolve is still unknown," Solomon said. "We're hopeful that feedback from companies, large and small, institutional investors and ultimately, consumers, support an approach that will lead to greater economic certainty and long term growth."

Revenues tied to equity trading soared 27 percent from the year-ago level, with Goldman benefiting from strong demand for its services to facilitate trading and providing financing to clients trading stocks.

The bank said its advisory revenues were significantly lower than in the year-ago period. However, Goldman's investment banking fees backlog increased compared with the end of 2024.

Investment bankers had been eyeing more deals with the shift to the Trump administration from the Biden years, where mergers had been viewed skeptically.

But deal flow has so far lagged behind expectations, with analysts citing a weakening macroeconomic backdrop.

Solomon still expressed optimism about dealmaking in 2025 even if there has been something of a pause.

"In a period of uncertainty, things will slow down. But again, it's a big, complex world. There's a lot of change going on. Dialogues are up," he said.

"I would expect a significant amount of (merger and acquisition) activity through the rest of the year," Solomon added.

Goldman's Asset and Wealth Management business posted a drop in revenues, due to significantly lower revenues in equity and debt investment, partially offset by higher management fees.

Shares rose 1.8 percent in early-afternoon trading.

C.Koch--VB