-

Emery targets 'next step' for Aston Villa after Champions League heroics

Emery targets 'next step' for Aston Villa after Champions League heroics

-

'Gap too big' for Dortmund after first leg, says Guirassy

-

Maradona's daughter says doctors could have prevented his death

Maradona's daughter says doctors could have prevented his death

-

Barcelona 'justified' semi-final spot despite Dortmund loss, says Flick

-

'We thought the tie was over': Dembele admits PSG switched off against Villa

'We thought the tie was over': Dembele admits PSG switched off against Villa

-

Wine consumption falls heavily into the red

-

Barca through to Champions League semis despite Guirassy hat-trick

Barca through to Champions League semis despite Guirassy hat-trick

-

Global stocks mixed amid lingering unease over trade war

-

PSG survive Aston Villa scare to reach Champions League semis

PSG survive Aston Villa scare to reach Champions League semis

-

Pandemic treaty talks fight late hurdles

-

Trump resurrects ghost of US military bases in Panama

Trump resurrects ghost of US military bases in Panama

-

Family seeks homicide charges against owners of collapsed Dominican nightclub

-

Sudan paramilitary chief declares rival government two years into war

Sudan paramilitary chief declares rival government two years into war

-

Boeing faces fresh crisis with US-China trade war

-

Trump eyes slashing State Department by 50 percent: US media

Trump eyes slashing State Department by 50 percent: US media

-

Canada offers automakers tariff relief, Honda denies weighing move

-

Facebook added 'value' to Instagram, Zuckerberg says in antitrust trial

Facebook added 'value' to Instagram, Zuckerberg says in antitrust trial

-

French Ligue 1 clubs vote to break TV deal with DAZN

-

Peru court sentences ex-president Humala to 15 years for graft

Peru court sentences ex-president Humala to 15 years for graft

-

Sumy buries mother and daughter victims of Russian double strike

-

Trump says ball in China's court on tariffs

Trump says ball in China's court on tariffs

-

Kane urges Bayern to hit the mark against Inter in Champions League

-

Trump ramps up conflict against defiant Harvard

Trump ramps up conflict against defiant Harvard

-

Arteta feeding Arsenal stars 'opposite' of comeback message

-

France's Macron honours craftspeople who rebuilt Notre Dame

France's Macron honours craftspeople who rebuilt Notre Dame

-

Watkins left on Villa bench for PSG return

-

Chahal stars as Punjab defend IPL's lowest total of 111 in 'best win'

Chahal stars as Punjab defend IPL's lowest total of 111 in 'best win'

-

French swim star Marchand considered taking year-long break

-

Chahal stars as Punjab defend IPL's lowest total of 111

Chahal stars as Punjab defend IPL's lowest total of 111

-

Universal Studios, Venice Beach to host LA 2028 events

-

IOM chief urges world to step up aid for Haiti

IOM chief urges world to step up aid for Haiti

-

French prisons hit by mystery arson and gunfire attacks

-

Alcaraz follows Ruud into Barcelona Open last 16

Alcaraz follows Ruud into Barcelona Open last 16

-

Stocks rise on bank earnings, auto tariff hopes

-

Trump showdown with courts in spotlight at migrant hearing

Trump showdown with courts in spotlight at migrant hearing

-

Ecuador electoral council rejects claims of fraud in presidential vote

-

Russia jails four journalists who covered Navalny

Russia jails four journalists who covered Navalny

-

Trump says China 'reneged' on Boeing deal as tensions flare

-

Trump eyes near 50 percent cut in State Dept budget: US media

Trump eyes near 50 percent cut in State Dept budget: US media

-

Trump says would 'love' to send US citizens to El Salvador jail

-

'Unprecedented' Europe raids net 200 arrests, drugs haul

'Unprecedented' Europe raids net 200 arrests, drugs haul

-

Everyone thinks Real Madrid comeback 'nailed-on': Bellingham

-

NATO's Rutte says US-led Ukraine peace talks 'not easy'

NATO's Rutte says US-led Ukraine peace talks 'not easy'

-

Harvey Weinstein New York retrial for sex crimes begins

-

More than 10% of Afghans could lose healthcare by year-end: WHO

More than 10% of Afghans could lose healthcare by year-end: WHO

-

Stocks rise as auto shares surge on tariff break hopes

-

Facebook chief Zuckerberg testifying again in US antitrust trial

Facebook chief Zuckerberg testifying again in US antitrust trial

-

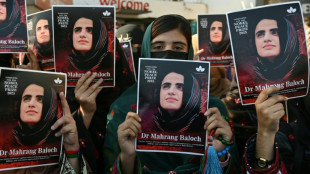

Pakistan court refuses to hear Baloch activist case: lawyers

-

Inzaghi pushing Inter to end San Siro hoodoo with Bayern and reach Champions League semis

Inzaghi pushing Inter to end San Siro hoodoo with Bayern and reach Champions League semis

-

Arsenal's Odegaard can prove point on Real Madrid return

Stocks rise on tech tariffs respite, gold hits new high

Stock markets rose firmly on Monday after fears over US President Donald Trump's trade war were tempered by tariff exemptions for smartphones, laptops, semiconductors and other electronic products.

But suggestions by Trump that the exemptions would be temporary added to market uncertainty as the dollar extended losses, helping gold to a fresh record high.

European indices jumped around two percent in midday deals following last week's rollercoaster for equities as the United States and China exchanged tit-for-tat levies.

That tracked gains in Asia, with tech firms helping push Hong Kong up more than two percent, while Tokyo and Shanghai also closed higher.

The United States on Friday appeared to slightly dial down the pressure on its trade war with Beijing, sparing electronic products -- for which China is a major source -- from painful "reciprocal" levies.

US levies imposed on China have risen to 145 percent, and Beijing set a retaliatory 125 percent band on US imports.

Trump on Sunday stressed that the exemptions had been misconstrued and that no country would get "off the hook" in his trade war -- especially China.

He said they would only be temporary as his team pursued fresh tariffs against many items on the list, including on semiconductors "over the next week".

The US leader's comments "have complicated matters with this category of goods apparently set to be placed in a different tariff 'bucket'", said AJ Bell investment director Russ Mould.

"Adding another layer of complexity on to an already complex trade policy may not be that well received by investors, but in the short term there is still likely to be palpable relief, particularly for the likes of Apple and Nvidia," he added.

Data on Monday showed Chinese exports soared more than 12 percent last month ahead of the swingeing tariffs, with the United States remaining the largest single destination, accounting for $115.6 billion worth of goods.

"But shipments are set to drop back over the coming months and quarters," warned Julian Evans-Pritchard, head of China economics at Capital Economics.

"It could be years before Chinese exports regain current levels."

Amid uncertainty over Trump's trade policy, the dollar extended losses against its major peers on Monday, with the euro around a three-year high and the Swiss franc at its strongest in 10 years.

Treasuries also remained under pressure amid worries that China and other nations might dump their vast holdings, which could call into question the US government bonds as a safe haven.

And gold, a go-to asset of safety in times of turmoil, hit a new peak of $3,245.75 an ounce Monday.

Wall Street finished solidly higher Friday, helped by comments from a top Federal Reserve official that the central bank was prepared to step in to support financial markets.

- Key figures around 1040 GMT -

London - FTSE 100: UP 1.9 percent at 8,113.90 points

Paris - CAC 40: UP 2.3 percent at 7,264.99

Frankfurt - DAX: UP 2.5 percent at 20,884.13

Tokyo - Nikkei 225: UP 1.2 percent at 33,982.36 (close)

Hong Kong - Hang Seng Index: UP 2.4 percent at 21,417.40 (close)

Shanghai - Composite: UP 0.8 percent at 3,262.81 (close)

New York - Dow: UP 1.6 percent at 40,212.71 (close)

Dollar/yen: DOWN at 143.16 yen from 143.49 yen on Friday

Euro/dollar: UP at $1.1388 from $1.1359

Pound/dollar: UP at $1.3184 from $1.3088

Euro/pound: DOWN at 86.36 pence from 86.80 pence

Brent North Sea Crude: UP 0.9 percent at $65.36 per barrel

West Texas Intermediate: UP 1.0 percent at $62.10 per barrel

P.Vogel--VB