-

French prisons hit by mystery arson and gunfire attacks

French prisons hit by mystery arson and gunfire attacks

-

Alcaraz follows Ruud into Barcelona Open last 16

-

Stocks rise on bank earnings, auto tariff hopes

Stocks rise on bank earnings, auto tariff hopes

-

Trump showdown with courts in spotlight at migrant hearing

-

Ecuador electoral council rejects claims of fraud in presidential vote

Ecuador electoral council rejects claims of fraud in presidential vote

-

Russia jails four journalists who covered Navalny

-

Trump says China 'reneged' on Boeing deal as tensions flare

Trump says China 'reneged' on Boeing deal as tensions flare

-

Trump eyes near 50 percent cut in State Dept budget: US media

-

Trump says would 'love' to send US citizens to El Salvador jail

Trump says would 'love' to send US citizens to El Salvador jail

-

'Unprecedented' Europe raids net 200 arrests, drugs haul

-

Everyone thinks Real Madrid comeback 'nailed-on': Bellingham

Everyone thinks Real Madrid comeback 'nailed-on': Bellingham

-

NATO's Rutte says US-led Ukraine peace talks 'not easy'

-

Harvey Weinstein New York retrial for sex crimes begins

Harvey Weinstein New York retrial for sex crimes begins

-

More than 10% of Afghans could lose healthcare by year-end: WHO

-

Stocks rise as auto shares surge on tariff break hopes

Stocks rise as auto shares surge on tariff break hopes

-

Facebook chief Zuckerberg testifying again in US antitrust trial

-

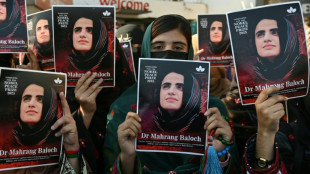

Pakistan court refuses to hear Baloch activist case: lawyers

Pakistan court refuses to hear Baloch activist case: lawyers

-

Inzaghi pushing Inter to end San Siro hoodoo with Bayern and reach Champions League semis

-

Arsenal's Odegaard can prove point on Real Madrid return

Arsenal's Odegaard can prove point on Real Madrid return

-

China's Xi begins Malaysia visit in shadow of Trump tariffs

-

Andrew Tate accusers suing for 'six-figure' sum, UK court hears

Andrew Tate accusers suing for 'six-figure' sum, UK court hears

-

Macron to honour craftspeople who rebuilt Notre Dame

-

Van der Poel E3 'spitter' facing fine

Van der Poel E3 'spitter' facing fine

-

Khamenei says Iran-US talks going well but may lead nowhere

-

Nearly 60,000 Afghans return from Pakistan in two weeks: IOM

Nearly 60,000 Afghans return from Pakistan in two weeks: IOM

-

Auto shares surge on tariff reprieve hopes

-

Sudan war drains life from once-thriving island in capital's heart

Sudan war drains life from once-thriving island in capital's heart

-

Trump trade war casts pall in China's southern export heartland

-

Ukraine's Sumy prepares to bury victims of 'bloody Sunday'

Ukraine's Sumy prepares to bury victims of 'bloody Sunday'

-

Iraq sandstorm closes airports, puts 3,700 people in hospital

-

French prisons targeted with arson, gunfire: ministry

French prisons targeted with arson, gunfire: ministry

-

Pandemic treaty talks inch towards deal

-

Employee dead, client critical after Paris cryotherapy session goes wrong

Employee dead, client critical after Paris cryotherapy session goes wrong

-

Howe will only return to Newcastle dugout when '100 percent' ready

-

Journalist recalls night Mario Vargas Llosa punched Gabriel Garcia Marquez

Journalist recalls night Mario Vargas Llosa punched Gabriel Garcia Marquez

-

Sudan marks two years of war with no end in sight

-

Vance urges Europe not to be US 'vassal'

Vance urges Europe not to be US 'vassal'

-

China tells airlines to suspend Boeing jet deliveries: report

-

Stocks rise as stability returns, autos surge on exemption hope

Stocks rise as stability returns, autos surge on exemption hope

-

Harvard sees $2.2bn funding freeze after defying Trump

-

'Tough' Singapore election expected for non-Lee leader

'Tough' Singapore election expected for non-Lee leader

-

Japan orders Google to cease alleged antitrust violation

-

Stocks rise as stability returns, autos lifted by exemption hope

Stocks rise as stability returns, autos lifted by exemption hope

-

Malawi's debt crisis deepens as aid cuts hurt

-

Danish brewer adds AI 'colleagues' to human team

Danish brewer adds AI 'colleagues' to human team

-

USAID cuts rip through African health care systems

-

Arsenal target Champions League glory to save season

Arsenal target Champions League glory to save season

-

Kane and Bayern need killer instinct with home final at stake

-

Mbappe leading Real Madrid comeback charge against Arsenal

Mbappe leading Real Madrid comeback charge against Arsenal

-

S. Korea plans extra $4.9 bn help for chips amid US tariff anxiety

Chinese exports soared in March ahead of Trump's 'Liberation Day'

China said Monday that exports soared more than 12 percent last month, beating expectations as businesses rushed to get ahead of swingeing tariffs imposed by US President Donald Trump on his so-called "Liberation Day".

Beijing and Washington have been locked in a fast-moving, high-stakes game of brinkmanship since Trump launched a global tariff assault that has particularly targeted Chinese imports.

Tit-for-tat exchanges have seen US levies imposed on China rise to 145 percent, and Beijing setting a retaliatory 125 percent toll on US imports.

Figures released by Beijing's General Administration of Customs on Monday showed a 12.4 percent jump in overseas shipments, more than double the 4.6 percent predicted in a Bloomberg survey.

Imports during the same period fell 4.3 percent, an improvement on the first two months of the year in a sign of rebounding domestic consumption.

Beijing also said Monday that the United States remained the largest single overseas destination for Chinese goods from January to March, amounting to $115.6 billion.

Last month, which saw a second round of US tariffs imposed on Chinese goods, the country's exports to the United States increased by about nine percent year-on-year, Beijing said.

China's top leaders have set an ambitious annual growth target of around five percent, vowing to make domestic demand its main economic driver.

But its fragile recovery faces fresh headwinds from Trump's trade war.

The US side appeared to dial down the pressure on Friday, listing tariff exemptions for smartphones, laptops, semiconductors and other electronic products of which China is a major source.

- Frontloading -

Analysts attributed the March surge to a rush to export ahead of Trump's April 2 "Liberation Day" tariffs on all trade partners that sent global markets tumbling.

"The strong export data reflect frontloading of trade before the US tariffs were announced," Zhiwei Zhang, President and Chief Economist at Pinpoint Asset Management said in a note.

"China's exports will likely weaken in coming months as the US tariffs skyrocket," he added.

"The uncertainty of trade policies is extremely high," Zhang said.

Julian Evans-Pritchard, head of China economics at Capital Economics, said in a note that "in anticipation of even higher duties, demand from US importers continued to hold up fairly well" in March.

"But shipments are set to drop back over the coming months and quarters," he added.

"It could be years before Chinese exports regain current levels."

And the world's second-largest economy continues to struggle with sluggish consumption and a prolonged debt crisis in its property sector.

Beijing last year announced a string of aggressive measures to reignite growth, including cutting interest rates, cancelling restrictions on homebuying, hiking the debt ceiling for local governments and bolstering support for financial markets.

But after a blistering market rally last year fuelled by hopes for a long-awaited "bazooka stimulus", optimism waned as authorities refrained from providing a specific figure for the bailout or fleshing out any of the pledges.

K.Sutter--VB