-

Stocks rise on bank earnings, auto tariff hopes

Stocks rise on bank earnings, auto tariff hopes

-

Trump showdown with courts in spotlight at migrant hearing

-

Ecuador electoral council rejects claims of fraud in presidential vote

Ecuador electoral council rejects claims of fraud in presidential vote

-

Russia jails four journalists who covered Navalny

-

Trump says China 'reneged' on Boeing deal as tensions flare

Trump says China 'reneged' on Boeing deal as tensions flare

-

Trump eyes near 50 percent cut in State Dept budget: US media

-

Trump says would 'love' to send US citizens to El Salvador jail

Trump says would 'love' to send US citizens to El Salvador jail

-

'Unprecedented' Europe raids net 200 arrests, drugs haul

-

Everyone thinks Real Madrid comeback 'nailed-on': Bellingham

Everyone thinks Real Madrid comeback 'nailed-on': Bellingham

-

NATO's Rutte says US-led Ukraine peace talks 'not easy'

-

Harvey Weinstein New York retrial for sex crimes begins

Harvey Weinstein New York retrial for sex crimes begins

-

More than 10% of Afghans could lose healthcare by year-end: WHO

-

Stocks rise as auto shares surge on tariff break hopes

Stocks rise as auto shares surge on tariff break hopes

-

Facebook chief Zuckerberg testifying again in US antitrust trial

-

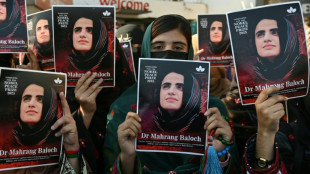

Pakistan court refuses to hear Baloch activist case: lawyers

Pakistan court refuses to hear Baloch activist case: lawyers

-

Inzaghi pushing Inter to end San Siro hoodoo with Bayern and reach Champions League semis

-

Arsenal's Odegaard can prove point on Real Madrid return

Arsenal's Odegaard can prove point on Real Madrid return

-

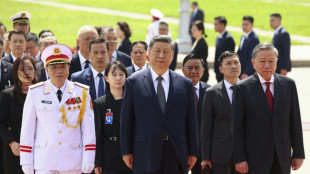

China's Xi begins Malaysia visit in shadow of Trump tariffs

-

Andrew Tate accusers suing for 'six-figure' sum, UK court hears

Andrew Tate accusers suing for 'six-figure' sum, UK court hears

-

Macron to honour craftspeople who rebuilt Notre Dame

-

Van der Poel E3 'spitter' facing fine

Van der Poel E3 'spitter' facing fine

-

Khamenei says Iran-US talks going well but may lead nowhere

-

Nearly 60,000 Afghans return from Pakistan in two weeks: IOM

Nearly 60,000 Afghans return from Pakistan in two weeks: IOM

-

Auto shares surge on tariff reprieve hopes

-

Sudan war drains life from once-thriving island in capital's heart

Sudan war drains life from once-thriving island in capital's heart

-

Trump trade war casts pall in China's southern export heartland

-

Ukraine's Sumy prepares to bury victims of 'bloody Sunday'

Ukraine's Sumy prepares to bury victims of 'bloody Sunday'

-

Iraq sandstorm closes airports, puts 3,700 people in hospital

-

French prisons targeted with arson, gunfire: ministry

French prisons targeted with arson, gunfire: ministry

-

Pandemic treaty talks inch towards deal

-

Employee dead, client critical after Paris cryotherapy session goes wrong

Employee dead, client critical after Paris cryotherapy session goes wrong

-

Howe will only return to Newcastle dugout when '100 percent' ready

-

Journalist recalls night Mario Vargas Llosa punched Gabriel Garcia Marquez

Journalist recalls night Mario Vargas Llosa punched Gabriel Garcia Marquez

-

Sudan marks two years of war with no end in sight

-

Vance urges Europe not to be US 'vassal'

Vance urges Europe not to be US 'vassal'

-

China tells airlines to suspend Boeing jet deliveries: report

-

Stocks rise as stability returns, autos surge on exemption hope

Stocks rise as stability returns, autos surge on exemption hope

-

Harvard sees $2.2bn funding freeze after defying Trump

-

'Tough' Singapore election expected for non-Lee leader

'Tough' Singapore election expected for non-Lee leader

-

Japan orders Google to cease alleged antitrust violation

-

Stocks rise as stability returns, autos lifted by exemption hope

Stocks rise as stability returns, autos lifted by exemption hope

-

Malawi's debt crisis deepens as aid cuts hurt

-

Danish brewer adds AI 'colleagues' to human team

Danish brewer adds AI 'colleagues' to human team

-

USAID cuts rip through African health care systems

-

Arsenal target Champions League glory to save season

Arsenal target Champions League glory to save season

-

Kane and Bayern need killer instinct with home final at stake

-

Mbappe leading Real Madrid comeback charge against Arsenal

Mbappe leading Real Madrid comeback charge against Arsenal

-

S. Korea plans extra $4.9 bn help for chips amid US tariff anxiety

-

Xi's Vietnam trip aiming to 'screw' US, says Trump

Xi's Vietnam trip aiming to 'screw' US, says Trump

-

Iran's top diplomat to visit Russia after US nuclear talks

Asset flight challenges US safe haven status

The US has long been considered a financial safe haven. The sell-off of the dollar, stocks and Treasury bonds in a spree sparked by panic at President Donald Trump's trade war is starting to raise questions about if that's still true.

- What happened this week to US assets? -

US equities and the greenback have been under pressure for weeks. This week, the volatility spread to the US Treasury market, long considered by global investors to be a refuge.

On Wednesday morning before Trump announced he was pausing many of his most onerous tariffs for 90 days, yields on both the 10-year and 30-year US Treasury bonds spiked suddenly.

Trump's pivot -- which sparked a mammoth equity market rally Wednesday afternoon -- also provided temporary relief to the US Treasury market. But yields began rising again on Thursday.

"There's clearly a flight from US bonds," said Steve Sosnick of Interactive Brokers. "That money is flowing out of the US bond market and doing so very quickly."

JPMorgan Chase CEO Jamie Dimon rejected the notion that US Treasuries were no longer a haven, but acknowledged an impact from recent market volatility.

"It does change the nature a little bit from the certainty point of view," Dimon said Friday, while adding that the United States still stands out as safe "in this turbulent world."

- Why are investors fleeing US bonds? -

The most obvious reason is that the near-term outlook on the US economy has deteriorated, with more economists betting on a recession due to tariff-related inflation and a slowdown in business investment amid policy uncertainty.

That's a big shift from just 80 days ago at the World Economic Forum where "everyone talked about US supremacy," BlackRock CEO Larry Fink said Friday.

Analysts also see the reaction as stemming from Trump's policies such as his "America First" agenda that frays ties with other countries and his proposed tax cuts that could mean bigger US deficits.

"Unconventional policies that gamble with a country's public finances and/or its growth outlook can cause bond investors to question the assumption that government debt is risk free," said a note from Berenberg Economics.

"The breakdown in the relationship between US Treasury yields and the dollar highlights the concerns of investors about Donald Trump's policy agenda," Berenberg said.

Analysts have said some of the selling in US Treasuries is likely from equity investors who need to raise cash quickly. There has also been speculation that the Chinese government could liquidate US Treasury holdings in the US-China trade war, although such a move would also badly hit Beijing.

- What will happen next? -

The safe nature of US Treasury bonds is connected to the reserve currency status of the dollar, a feature that allows the United States to operate with much larger fiscal deficits than other countries.

Since Trump's inauguration, the euro has risen 10 percent against the greenback.

Still there is very little talk of a shift in the dollar's status anytime soon. The greenback is the currency in which oil and other global commodities trade. Central banks around the world will continue to hold assets in dollars and US Treasuries.

"There will be scarring impacts from this, but I don't think it's going to dislocate the dollar as the de facto global currency," said Will Compernolle of FHN Financial. "I just don't see any other alternative for now."

BlackRock's Fink remains bullish on the United States long-term, noting planned investments in artificial intelligence and infrastructure that will fuel growth.

Trump policies such as tax cuts and deregulation will "unlock an amazing amount of private capital," predicted Fink, who believes this upbeat future has been "obscured" by tariffs.

Morgan Stanley CEO Ted Pick said corporate deals could soon pick up, viewing Trump's proposed tax cuts and deregulation as catalysts that may allow clients to say "we will go forward."

D.Schaer--VB