-

Gaza civil defence describes medic killings as 'summary executions'

Gaza civil defence describes medic killings as 'summary executions'

-

Francis: radical leader who broke the papal mould

-

Oscar stars, Max keeps mum, Sainz alive - Saudi GP talking points

Oscar stars, Max keeps mum, Sainz alive - Saudi GP talking points

-

Iyer, Kishan win back India contracts as Pant's deal upgraded

-

Vance lands in India for tough talks on trade

Vance lands in India for tough talks on trade

-

Inside South Africa's wildlife CSI school helping to catch poachers

-

Nigerian Afrobeat legend Femi Kuti takes a look inward

Nigerian Afrobeat legend Femi Kuti takes a look inward

-

Kim Kardashian: From sex tape to Oval Office via TV and Instagram

-

Vance in India for tough talks on trade

Vance in India for tough talks on trade

-

Thunder crush Grizzlies as Celtics, Cavs and Warriors win

-

Vance heads to India for tough talks on trade

Vance heads to India for tough talks on trade

-

China slams 'appeasement' of US as nations rush to secure trade deals

-

'Grandpa robbers' go on trial for Kardashian heist in Paris

'Grandpa robbers' go on trial for Kardashian heist in Paris

-

Swede Lindblad gets first win in just third LPGA start

-

Gold hits record, dollar drops as tariff fears dampen sentiment

Gold hits record, dollar drops as tariff fears dampen sentiment

-

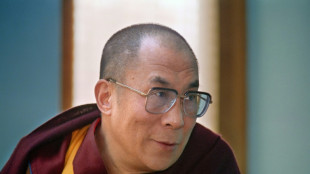

As Dalai Lama approaches 90, Tibetans weigh future

-

US defense chief shared sensitive information in second Signal chat: US media

US defense chief shared sensitive information in second Signal chat: US media

-

Swede Lingblad gets first win in just third LPGA start

-

South Korea ex-president back in court for criminal trial

South Korea ex-president back in court for criminal trial

-

Thunder crush Grizzlies, Celtics and Cavs open NBA playoffs with wins

-

Beijing slams 'appeasement' of US in trade deals that hurt China

Beijing slams 'appeasement' of US in trade deals that hurt China

-

Trump in his own words: 100 days of quotes

-

Padres say slugger Arraez 'stable' after scary collision

Padres say slugger Arraez 'stable' after scary collision

-

Trump tariffs stunt US toy imports as sellers play for time

-

El Salvador offers to swap US deportees with Venezuela

El Salvador offers to swap US deportees with Venezuela

-

Higgo holds on for win after Dahmen's late collapse

-

El Salvador's president proposes prisoner exchange with Venezuela

El Salvador's president proposes prisoner exchange with Venezuela

-

Gilgeous-Alexander, Jokic, Antetokounmpo named NBA MVP finalists

-

Thomas ends long wait with playoff win over Novak

Thomas ends long wait with playoff win over Novak

-

Thunder rumble to record win over Grizzlies, Celtics top Magic in NBA playoff openers

-

Linesman hit by projectile as Saint-Etienne edge toward safety

Linesman hit by projectile as Saint-Etienne edge toward safety

-

Mallia guides Toulouse to Top 14 win over Stade Francais

-

Israel cancels visas for French lawmakers

Israel cancels visas for French lawmakers

-

Russia and Ukraine trade blame over Easter truce, as Trump predicts 'deal'

-

Valverde stunner saves Real Madrid title hopes against Bilbao

Valverde stunner saves Real Madrid title hopes against Bilbao

-

Ligue 1 derby interrupted after assistant referee hit by projectile

-

Leclerc bags Ferrari first podium of the year

Leclerc bags Ferrari first podium of the year

-

Afro-Brazilian carnival celebrates cultural kinship in Lagos

-

Ligue 1 derby halted after assistant referee hit by projectile

Ligue 1 derby halted after assistant referee hit by projectile

-

Thunder rumble with record win over Memphis in playoff opener

-

Leverkusen held at Pauli to put Bayern on cusp of title

Leverkusen held at Pauli to put Bayern on cusp of title

-

Israel says Gaza medics' killing a 'mistake,' to dismiss commander

-

Piastri power rules in Saudi as Max pays the penalty

Piastri power rules in Saudi as Max pays the penalty

-

Leaders Inter level with Napoli after falling to late Orsolini stunner at Bologna

-

David rediscovers teeth as Chevalier loses some in nervy Lille win

David rediscovers teeth as Chevalier loses some in nervy Lille win

-

Piastri wins Saudi Arabian Grand Prix, Verstappen second

-

Kohli, Rohit star as Bengaluru and Mumbai win in IPL

Kohli, Rohit star as Bengaluru and Mumbai win in IPL

-

Guirassy helps Dortmund past Gladbach, putting top-four in sight

-

Alexander-Arnold lauds 'special' Liverpool moments

Alexander-Arnold lauds 'special' Liverpool moments

-

Pina strikes twice as Barca rout Chelsea in Champions League semi

Stock markets tumble as Trump targets booze

Global stock markets slid on Thursday, especially on Wall Street, as US President Donald Trump launched a new volley in his trade war, while gold hit a new record high.

Worries about a potential US government shutdown by the weekend also worried investors, while Russian President Vladimir Putin's limited backing of a possible ceasefire in Ukraine failed to boost sentiment.

Trump threatened Thursday to impose 200 percent tariffs on wine, champagne and other alcoholic products from France and other European Union countries in retaliation against the bloc's planned levies on US-produced whiskey, part of the EU's reprisals for US tariffs on steel and aluminum imports.

"President Trump's threat of more tariffs, this time a 200 percent tariff on alcoholic beverages from the EU, has led to the resumption of the... sell-off in global stock indices," said analyst Axel Rudolph at online trading platform IG.

Trump has launched trade wars against competitors and partners alike since taking office, wielding tariffs as a tool to pressure countries on commerce and other policy issues.

Shares in luxury giant LVMH, which owns several champagne houses including Dom Perignon and Hennessy cognac, slid 1.1 percent.

Shares in French drinks group Pernod Ricard, which owns two champagne houses and Jameson Irish Whiskey, tumbled about four percent.

The Paris stock exchange finished the day down 0.6 percent and Frankfurt shed 0.5 percent. London ended the day flat.

Wall Street's three main indices finished the day down sharply.

The S&P 500 Index tumbled into a technical correction, or down 10 percent from its highest point of the year, recorded just last month.

CFRA Research chief investment strategist Sam Stovall told AFP that the correction stemmed from "the tariff threats and the uncertainty surrounding retribution, (and) surrounding the possibility of recession as a result."

"The only problem is we don't know exactly how long it will go," Stovall said.

The drop came despite data showing US producer inflation was flat in February, defying expectations of an uptick as Trump's tariff hikes targeting Chinese goods took effect.

"That's pretty good news in terms of inflation but the problem is, you have a trade war that's expanding," said Peter Cardillo of Spartan Capital Securities.

Gold, seen as a safe haven, struck an all-time high of $2,988.54 per ounce, surpassing its late February record.

Trump's tariffs and pledges to slash taxes, regulations and immigration have sparked market volatility and concerns that the measures could reignite inflation.

That in turn could force the US Federal Reserve to lift interest rates again, potentially causing a recession.

Traders were also waiting on a decision from Russia on whether to mirror Ukraine's acceptance of a 30-day ceasefire as proposed by the United States.

Putin appeared to condition a 30-day ceasefire that the Trump administration has been pushing on Russian troops ejecting Ukrainian forces from Russia's Kursk region.

- Key figures around 2100 GMT -

New York - Dow: DOWN 1.3 percent at 40,813.57 points (close)

New York - S&P 500: DOWN 1.4 percent at 5,521.52 (close)

New York - Nasdaq Composite: DOWN 1.96 percent at 17,303.01 (close)

London - FTSE 100: FLAT at 8,542.56 (close)

Paris - CAC 40: DOWN 0.6 percent at 7,938.21 (close)

Frankfurt - DAX: DOWN 0.5 percent at 22,567.14 (close)

Tokyo - Nikkei 225: DOWN 0.1 percent at 36,790.03 (close)

Hong Kong - Hang Seng Index: DOWN 0.6 percent at 23,462.65 (close)

Shanghai - Composite: DOWN 0.4 percent at 3,358.73 (close)

Euro/dollar: DOWN at $1.0849 from $1.0890 on Wednesday

Pound/dollar: DOWN at $1.2948 from $1.2969

Dollar/yen: DOWN at 147.75 yen from 148.32 yen

Euro/pound: DOWN at 83.75 pence from 83.97 pence

West Texas Intermediate: DOWN 1.67 percent at $66.55 per barrel

Brent North Sea Crude: DOWN 1.51 percent at $69.88 per barrel

burs-sst/jgc

M.Schneider--VB