-

Nuggets edge Clippers in NBA playoff overtime thriller, Pacers thump Bucks

Nuggets edge Clippers in NBA playoff overtime thriller, Pacers thump Bucks

-

Unbeaten Miami edge Columbus in front of big crowd in Cleveland

-

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

-

Another round of anti-Trump protests hits US cities

-

'So grateful' - Dodgers star Ohtani and wife welcome first child

'So grateful' - Dodgers star Ohtani and wife welcome first child

-

PSG maintain unbeaten Ligue 1 record, Marseille back up to second

-

US, Iran report progress in nuclear talks, will meet again

US, Iran report progress in nuclear talks, will meet again

-

US Supreme Court intervenes to block Trump deportations

-

Hamas armed wing says fate of US-Israeli captive unknown

Hamas armed wing says fate of US-Israeli captive unknown

-

Pacers thump Bucks to open NBA playoffs

-

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

-

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

-

'Fuming' Watkins fires Villa in bid to prove Emery wrong

'Fuming' Watkins fires Villa in bid to prove Emery wrong

-

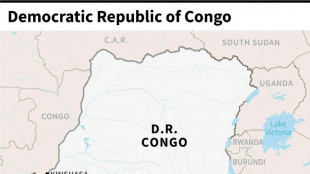

DR Congo boat fire toll revised down to 33

-

England thrash Scotland to set up France Grand Slam showdown

England thrash Scotland to set up France Grand Slam showdown

-

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

-

McTominay fires Napoli level with Inter as Conte fuels exit rumours

McTominay fires Napoli level with Inter as Conte fuels exit rumours

-

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

-

Man City boost top five bid, Aston Villa thrash in-form Newcastle

Man City boost top five bid, Aston Villa thrash in-form Newcastle

-

Villa rout Newcastle to rekindle bid to reach Champions League

-

Dumornay gives Lyon lead over Arsenal in Women's Champions League semis

Dumornay gives Lyon lead over Arsenal in Women's Champions League semis

-

Trans rights supporters rally in London, Edinburgh after landmark ruling

-

'We have to wait': Barca's Flick on Lewandowski injury fear

'We have to wait': Barca's Flick on Lewandowski injury fear

-

Bordeaux-Begles backups edge Pau to close in on Top 14 summit

-

Trans rights supporters rally outside in London, Edinburgh after landmark ruling

Trans rights supporters rally outside in London, Edinburgh after landmark ruling

-

PSG beat Le Havre to stay on course for unbeaten Ligue 1 season

-

Man City close in on Champions League with Everton late show

Man City close in on Champions League with Everton late show

-

14-year-old Vaibhav Suryavanshi becomes youngest IPL player

-

Barca make stunning comeback to beat Celta Vigo in Liga thriller

Barca make stunning comeback to beat Celta Vigo in Liga thriller

-

Zverev sets up birthday bash with Shelton in Munich

-

Man City boost top five bid, Southampton snatch late leveller

Man City boost top five bid, Southampton snatch late leveller

-

US Supreme Court intervenes to pause Trump deportations

-

Alcaraz and Rune race into Barcelona final

Alcaraz and Rune race into Barcelona final

-

US, Iran to hold more nuclear talks after latest round

-

Man City close in on Champions League thanks to Everton late show

Man City close in on Champions League thanks to Everton late show

-

Bayern close in on Bundesliga title with Heidenheim thumping

-

Tunisia opposition figures get jail terms in mass trial

Tunisia opposition figures get jail terms in mass trial

-

Putin announces 'Easter truce' in Ukraine

-

McLaren duo in ominous show of force in Saudi final practice

McLaren duo in ominous show of force in Saudi final practice

-

Afghan PM condemns Pakistan's 'unilateral' deportations

-

Iran says to hold more nuclear talks with US after latest round

Iran says to hold more nuclear talks with US after latest round

-

Comeback queen Liu leads US to World Team Trophy win

-

Buttler fires Gujarat to top of IPL table in intense heat

Buttler fires Gujarat to top of IPL table in intense heat

-

Unimpressive France stay on course for Grand Slam showdown

-

Shelton fights past Cerundolo to reach Munich ATP final

Shelton fights past Cerundolo to reach Munich ATP final

-

Vance and Francis: divergent values but shared ideas

-

Iran, US conclude second round of high-stakes nuclear talks in Rome

Iran, US conclude second round of high-stakes nuclear talks in Rome

-

Dumornay gives Lyon first leg lead over Arsenal in women's Champions League semis

-

Trans rights supporters rally outside UK parliament after landmark ruling

Trans rights supporters rally outside UK parliament after landmark ruling

-

Rune destroys Khachanov to reach Barcelona Open final

China cuts lending rates, boosting property firms

China further reduced bank lending costs Thursday in the latest move to boost its stuttering economy, providing some much-needed support to the country's beleaguered developers.

Property firm shares and bonds surged on the fresh rate cut from People's Bank of China -- the second in two months -- days after Beijing reported slower growth in the final months of 2021.

The slowing real estate industry has put downward pressure on growth, with several large companies including debt-laden development giant Evergrande defaulting in recent months.

The central bank said it had lowered the one-year loan prime rate (LPR) to 3.7 percent, from 3.8 percent in December.

It had reduced the LPR -- which guides how much interest commercial banks charge to corporate borrowers -- in December, for the first time in 20 months, as the economy was threatened by the real estate crisis and coronavirus flare-ups.

The launch of a regulatory drive last year to curb speculation and leverage had cut off avenues to crucially needed cash, sparking a crisis in the property sector.

But investors regained confidence amid expectations of regulatory easing with shares in Hong Kong-listed Agile Group up more than six percent and Country Garden climbing 7.4 percent.

Property developer bonds also surged Thursday on news of the rate cut, in what Bloomberg said was a record-breaking rally, highlighting the huge sums of money primed to flow into distressed securities if the property sector crackdown was eased.

Thursday's move comes after the world's second-biggest economy reported strong 8.1 percent growth in 2021, but with the first half of the year accounting for much of that growth.

The central bank also cut the interest rate on its one-year policy loans on Monday -- the first drop in the key rate for loans to financial institutions since early 2020.

- 'Targeted support' -

China was the only major economy to expand in 2020, after quickly bringing the outbreak under control.

But the country is now battling several localised virus clusters as it deals with the ongoing property market slump and fallout from a wide-ranging regulatory crackdown last year.

"Today's reductions to both the one-year and five-year Loan Prime Rates (LPR) continue the PBOC's efforts to push down borrowing costs," said Sheana Yue, China economist at Capital Economics.

She said the cuts mean "mortgages will now be slightly cheaper, which should help shore up housing demand."

"Targeted support for property buyers does appear to be limiting one of the more severe downside risks facing the economy."

Hong Kong-listed China Aoyuan Group became the latest major developer to miss bond payments, saying in a filing it would be unable to pay two notes due Thursday and Saturday, amounting to $688 million in total.

Fitch Ratings also downgraded its rating for real estate giant Sunac China Holdings, warning the developer would have to use its cash reserves to pay off debts maturing soon.

Y.Bouchard--BTB